What’s inside

Social Security: a simple concept 1

What you need to know about Social Security

while you’re working 4

What you need to know about benefits 6

Benefits for your family 11

When you’re ready to apply for benefits 14

Supplemental Security Income (SSI) program 16

Right to appeal 17

Online personal “my Social Security” account 17

Medicare 18

Some facts about Social Security 22

Contacting Us 23

1

Social Security: a simple concept

Social Security reaches almost every family, and at some

point, touches the lives of nearly all Americans.

We help older Americans, workers who develop

disabilities, and families in which a spouse or parent dies.

We estimate that about 180 million people will work in

Social Security-covered employment in 2023 and pay

Social Security taxes. As of September 2023, about 67

million people received monthly Social Security benets.

Most of our beneciaries are retirees and their families

— about 52 million people in September 2023.

But Social Security was never meant to be the only source

of income for people when they retire. Social Security

replaces a percentage of a worker’s pre-retirement

income based on your lifetime earnings. The amount of

your average earnings that Social Security retirement

benets replaces depends on your earnings and when

you choose to start benets. If you start benets in 2023

at your “full retirement age” (see our “Full retirement age”

section), this percentage ranges from as much as 78%

for very low earners, to about 42% for medium earners, to

about 28% for maximum earners. If you start benets after

full retirement age, these percentages would be higher.

If you start benets earlier, these percentages would be

lower. Most nancial advisers say you will need about

70 to 80% of pre-retirement income to live comfortably

in retirement, including your Social Security benets,

investments, and personal savings.

We want you to understand what Social Security can

mean to you and your family’s nancial future. This

publication, Understanding the Benets, explains the

basics of the Social Security retirement, disability, and

survivors insurance programs.

2

The current Social Security system works like this: when

you work, you pay taxes into Social Security. We use the

tax money to pay benets to:

• People who have already retired.

• People with qualifying disabilities.

• Survivors of workers who have died.

• Dependents of beneciaries.

The money you pay in taxes isn’t held in a personal

account for you to use when you get benets. We use

your taxes to pay people who are getting benets right

now. Any unused money goes to the Social Security trust

funds, not a personal account with your name on it.

Social Security is more than retirement

Many people think of Social Security as just a retirement

program. Most of the people receiving benets are retired,

but others receive benets because they’re:

• Someone with a qualifying disability.

• A spouse or child of someone getting benets.

• A divorced spouse of someone getting or eligible for

Social Security.

• A spouse or child of a worker who died.

• A divorced spouse of a worker who died.

• A dependent parent of a worker who died.

Based on your circumstances, you may be eligible for

Social Security at any age. In fact, we pay more benets

to children than any other government program.

Your Social Security taxes

We use the Social Security taxes you and other workers

pay into the system to pay Social Security benets.

You pay Social Security taxes based on your earnings, up

to a certain amount. In 2024, that amount is $168,600.

3

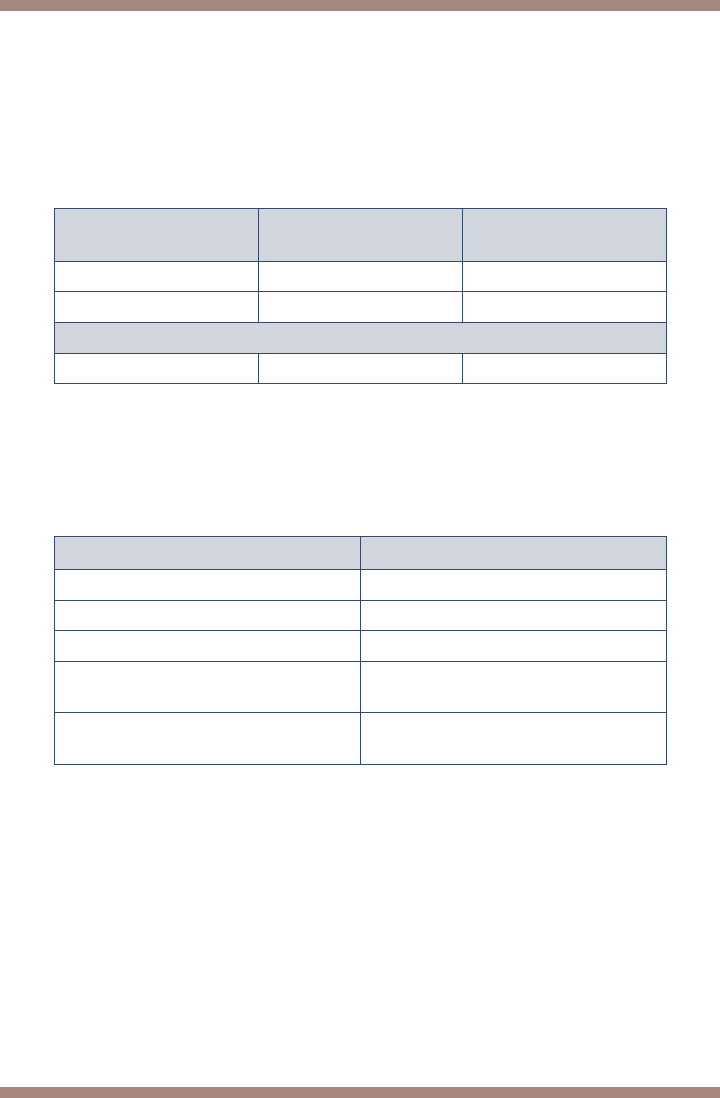

Medicare taxes

You pay Medicare taxes on all of your wages or net

earnings from self-employment. These taxes are for

Medicare coverage. There are additional Medicare taxes

for higher-income workers.

If you work for

someone else

Social Security

tax

Medicare tax

You pay 6.2% 1.45%

Your employer pays 6.2% 1.45%

If you’re self-employed

You pay 12.4% 2.9%

Additional Medicare tax

Workers pay an additional 0.9% Medicare tax on income

that exceeds certain thresholds. The chart below shows

the threshold amounts based on tax ling status:

Filing status Threshold amount

Married ling jointly $250,000

Married ling separately $125,000

Single $200,000

Head of household

(with qualifying person)

$200,000

Qualifying surviving spouse with

dependent child

$200,000

Where your Social Security tax dollars go

In 2024, when you work, about 85 cents of every Social

Security tax dollar you pay goes to a trust fund. This fund

pays monthly benets to current retirees and their families

and to surviving spouses and children of workers who

have died. About 15 cents goes to a trust fund that pays

benets to people with disabilities and their families.

4

From these trust funds, we also pay the costs of

managing our programs. We’re one of the most efcient

agencies in the federal government, and we’re working

to make it better every day. Of each Social Security tax

dollar you pay, we spend less than 1 penny to manage

the program.

The entire amount of Medicare taxes you pay goes

to a trust fund that pays some costs of hospital and

related care for all Medicare beneciaries. The Centers

for Medicare & Medicaid Services, not Social Security,

manages Medicare.

What you need to know about Social Security

while you’re working

Your Social Security number

Your link with us is your Social Security number.

You need it to get a job and pay taxes. We use your

Social Security number to track your earnings while

you’re working and your benets after you’re getting

Social Security.

Don’t carry your Social Security card. You should be

careful about giving someone your Social Security

number. Identity theft is one of the fastest growing crimes

today. Most of the time, identity thieves use your Social

Security number and your good credit to apply for more

credit in your name. Then, they use the credit cards and

don’t pay the bills.

Your Social Security number and our records are

condential. If someone else asks us for information we

have about you, we won’t give any information without

your written consent, unless the law requires or permits it.

5

Do you need to request a Social Security number, a

replacement card, or make a name change on your

current card? Our Social Security Number and Card page

at www.ssa.gov/number-card can help you nd the best

way to get what you need.

On this page, we ask you a series of questions to

determine whether you can:

• Complete the application process online.

• Start the application process online, then bring any

required documents to your local ofce to complete the

application, typically in less time. In many cases, you

can make an appointment online.

Once you complete your application (online or in person),

we will process the application, then mail the card. Please

understand that we don’t issue cards at our ofces.

To get a Social Security number or a replacement card,

you may need to show us proof of your U.S. citizenship or

immigration status, age, and identity. We don’t need proof

of your U.S. citizenship and age for a replacement card

if they’re already in our records. We only accept certain

documents as proof of U.S. citizenship. These include

your U.S. birth certicate, U.S. passport, Certicate of

Naturalization, or Certicate of Citizenship. If you aren’t

a U.S. citizen, we must see your immigration document

proving your work authorization. If you don’t have work

authorization, different rules apply.

For proof of identity, we accept current documents

showing your name, identifying information, and

preferably a recent photograph. Such a document may be

a driver’s license or other state-issued identication card,

or a U.S. passport.

To apply for a name change on your Social Security card,

you may need to show a recently issued document that

proves your name has been legally changed.

6

Be sure to safeguard your Social Security card. We limit

the number of replacement cards you can get to 3 in a

year and 10 during your lifetime. Legal name changes

and other exceptions don’t count toward these limits. For

example, changes in noncitizen status that require card

updates may not count toward these limits. These limits

may not apply if you can prove you need the card to

prevent a signicant hardship.

For more information, read Your Social Security Number

and Card (Publication No. 05-10002). If you aren’t a

citizen, read Social Security Numbers for Noncitizens

(Publication No. 05-10096).

Our card services are free. We never charge for the card

services we provide.

How you become eligible for Social Security

As you work and pay taxes, you earn Social Security

“credits.” In 2024, you earn 1 credit for each $1,730 in

earnings — up to a maximum of 4 credits per year. The

amount of money needed to earn 1 credit usually goes up

every year.

Most people need 40 credits (10 years of work) to be

eligible for benets. Younger people need fewer credits

to be eligible for disability benets or for their family

members to be eligible for survivors benets when the

worker dies.

What you need to know about benets

Social Security benets only replace some of your

earnings when you retire, develop a qualifying disability,

or die. We base your benet payment on how much

you earned during your working career. Higher lifetime

earnings result in higher benets. If there were some

years when you didn’t work, or had low earnings, your

benet amount may be lower than if you worked steadily.

7

Retirement benets

Choosing when to start receiving retirement benets is

one of the most important decisions you’ll ever make. If

you choose to start receiving benets when you reach

your full retirement age, you’ll receive your full benet

amount. We will reduce your benet amount if you begin

receiving benets before you reach full retirement age.

You can also choose to continue working beyond your

full retirement age. If you do, your benet will increase

from the time you reach full retirement age, until you start

receiving benets, or until you reach age 70.

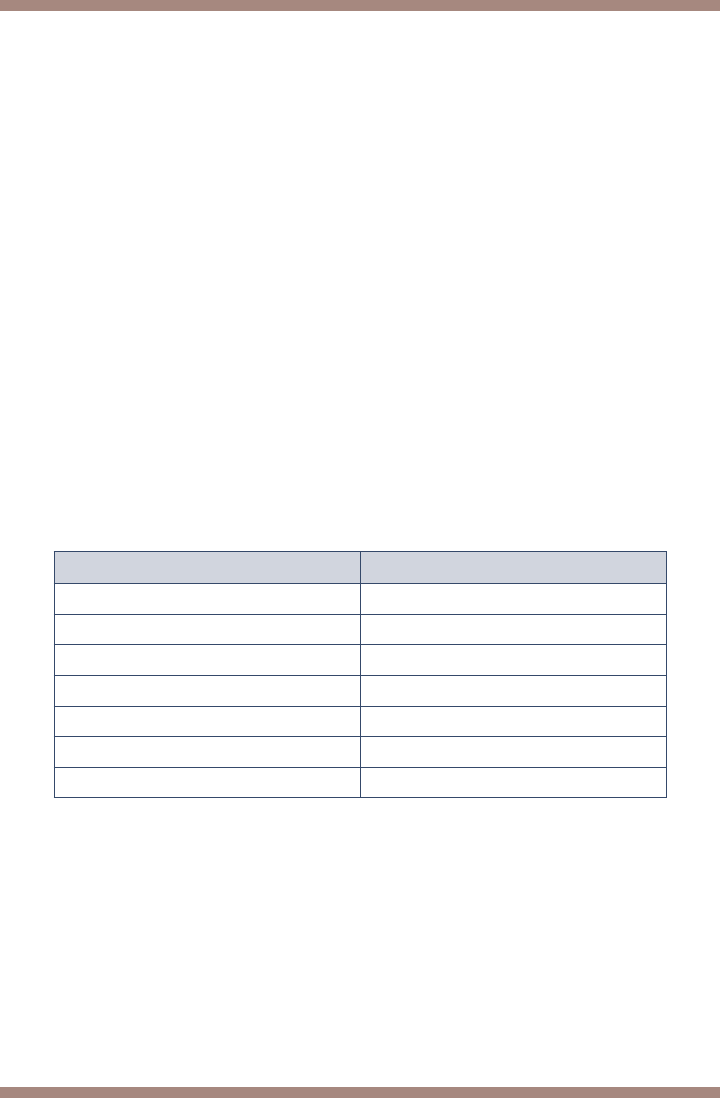

Full retirement age

If you were born from 1943 to 1960, the age at which full

retirement benets are payable increases gradually to

age 67. In 2024, if your birth year is 1956 or earlier, you’re

already eligible for your full Social Security benet. Use

the chart below to nd out your full retirement age.

Year of birth Full retirement age

1943-1954 66

1955 66 and 2 months

1956 66 and 4 months

1957 66 and 6 months

1958 66 and 8 months

1959 66 and 10 months

1960 or later 67

NOTE: Although the full retirement age is now above

65, you should still apply for Medicare benets 3 months

before your 65th birthday. If you wait longer, your

Medicare medical insurance (Part B) and prescription

drug coverage (Part D) may cost you more money.

8

Delayed retirement

If you choose to delay receiving benets beyond your

full retirement age, we’ll increase your benet a certain

percentage, depending on the year of your birth. We’ll add

the increase automatically each month from the time you

reach full retirement age, until you start receiving benets

or reach age 70, whichever comes rst. There is more

information on delayed retirement credits on our website

at www.ssa.gov/benets/retirement/planner/delayret.

html.

Early retirement

You may start receiving benets as early as age 62.

We reduce your benets if you start early by about 0.5

percentage points on average for each month you start

receiving benets before your full retirement age. For

example, if your full retirement age is 67, and you sign up

for Social Security when you’re 62, you would only get

about 70% of your full benet.

Once you’ve made the decision about when to start

benets, you can apply for Social Security retirement

benets on our website at www.ssa.gov/retirement.

If you work and get benets

You can continue to work and still receive retirement

benets. Your earnings in (or after) the month you reach

full retirement age won’t reduce your Social Security

benets. In fact, working beyond full retirement age can

increase your benets. We’ll have to reduce your benets,

however, if your earnings exceed certain limits for the

months before you reach your full retirement age.

If you work, but start receiving benets before full

retirement age, we deduct $1 in benets for every $2 in

earnings you have above the annual limit. In 2024, the

limit is $22,320.

9

In the year you reach your full retirement age, we reduce

your benets by $1 for every $3 you earn over a different

annual limit ($59,520 in 2024). This will continue until the

month you reach full retirement age.

Once you reach full retirement age, you can keep

working, and we won’t reduce your Social Security

retirement benet, no matter how much you earn.

For more information about how work affects your

benets, read How Work Affects Your Benets

(Publication No. 05-10069).

NOTE: People who work and receive Social Security

disability benets or SSI payments have different

earnings rules. They must immediately report all their

earnings to us no matter how much they earn.

Retirement benets for surviving spouses

If you receive surviving spouse’s benets, you can switch

to your own retirement benets as early as age 62. This

can be done assuming your retirement benet is more

than the amount you receive on your deceased spouse’s

earnings. Often, you can begin receiving one benet at

a reduced rate and then switch to the other benet at the

full rate when you reach full retirement age. The rules are

complicated and vary depending on your situation, so talk

to one of our representatives about the choices available

to you.

For more information about retirement benets, read

Retirement Benets (Publication No. 05-10035).

Disability benets

If you can’t work because of a physical or mental

condition that has lasted or is expected to last at least

1 year or result in death, you may be eligible for Social

Security disability benets.

10

Our disability rules are different from private or other

government agency plans. If you are eligible for

disability from another agency or program, it doesn’t

mean you will be eligible for disability benets from

us. Having a statement from your doctor saying you

have a disability doesn’t mean you’ll automatically be

eligible for Social Security disability benets. For more

information about Social Security disability benets, read

Disability Benets (Publication No. 05-10029). You can

apply for Social Security disability benets on our website

at www.ssa.gov/benets/disability.

People, including children, who have little income and

few resources, and who have a disability, may be eligible

for disability payments through the SSI program. For

more information about SSI, read Supplemental Security

Income (SSI) (Publication No. 05-11000).

If you develop a disability, le for disability benets

as soon as possible, because it usually takes several

months to process a disability claim. We may be able to

process your claim more quickly if you have the following

information when you apply:

• Medical records and treatment dates from your

doctors, therapists, hospitals, clinics, and caseworkers.

• Your laboratory and other test results.

• The names, addresses, phone and fax numbers of

your doctors, clinics, and hospitals.

• The names of all medications you’re taking.

• The names of your employers and job duties for the

last 15 years.

Your benets may be taxable

Some people who get Social Security will have to pay

income tax on their benets. In 2022, an estimated 48%

of Social Security beneciaries had countable income that

exceeded the thresholds. This required them to include a

11

portion of their Social Security benets in adjusted gross

income and giving them some income tax liability on their

Social Security benets.

You may have to pay taxes on your benets if you le

a federal tax return as an “individual” and your total

income is more than $25,000. If you le a joint return,

you may have to pay taxes if you and your spouse have

a total income that is more than $32,000. For more

information, call the Internal Revenue Service’s toll-free

number, 1-800-829-3676.

Benets for your family

When you start receiving Social Security retirement or

disability benets, other family members may also be

eligible to receive benets. For example, benets can be

paid to your spouse:

• If they’re age 62 or older.

• At any age if they’re caring for your child (the child

must be younger than 16 or have a disability and

entitled to Social Security benets on your record).

Benets can also be paid to your unmarried children

if they’re:

• Younger than 18.

• Between 18 and 19 years old, but in elementary or

secondary school as full-time students.

• Age 18 or older and have a qualifying disability (the

disability must have started before age 22).

Under certain circumstances, we can also pay benets

to a stepchild, grandchild, step-grandchild, or an adopted

child. If you become the parent of a child after you begin

receiving benets, let us know about the child, so we can

decide if the child is eligible for benets.

12

How much can family members get?

Each family member may be eligible for a monthly benet

that is up to half of your Social Security retirement or

disability benet amount. However, there is a limit to the

total amount of money that can be paid to you and your

family. The limit varies but is generally equal to about

150% to 180% of your retirement or disability benet.

If you’re divorced

If you’re divorced, your ex-spouse may be eligible for

benets on your earnings. In some situations, they may

get benets even if you don’t receive them. To be eligible,

a divorced spouse must:

• Have been married to you for at least 10 years.

• Have been divorced from you at least 2 years if you

have not led for benets yet.

• Be at least 62 years old.

• Be unmarried.

• Depending on the circumstances, not be entitled to or

eligible for a benet on their own work that is equal to

or higher than half the full amount on your record.

Survivors benets

When you die, your family may be eligible for benets

based on your work.

Family members who can collect benets include a

surviving spouse who is:

• 60 or older.

• 50 or older and has a qualifying disability.

• Any age if they care for your child who is younger than

16 or has a qualifying disability and is entitled to Social

Security benets on your record.

Your children can receive benets, too, if they’re

unmarried and:

13

• Younger than 18 years old.

• Between 18 and 19 years old, but in an elementary or

secondary school as full-time students.

• Age 18 or older and has a qualifying disability (the

disability must have started before age 22).

Additionally, your parents can receive benets on your

earnings if they were dependent on you for at least half of

their support.

One-time payment after death

If you have enough credits, a one-time payment of $255

also may be made after your death. This benet may

be paid to your spouse or minor children if they meet

certain requirements.

If you’re divorced and have a surviving ex-spouse

If you’re divorced, your ex-spouse may be eligible for

survivor’s benets based on your earnings when you die.

They must:

• Be at least age 60 years old (or 50 if they have a

qualifying disability) and have been married to you for

at least 10 years.

• Be at any age if they care for a child who is eligible for

benets based on your earnings.

• Not be entitled to a benet based on their own work

that is equal or higher than the full insurance amount

on your record.

• Not be currently married, unless the remarriage

occurred after age 60 or after age 50 if they have a

qualifying disability.

Benets paid to an ex-spouse won’t affect the benet

rates for other survivors receiving benets on your

earnings record.

14

NOTE: If you’re deceased and your ex-spouse remarries

after age 60, they may be eligible for Social Security

benets based on either your work or the new spouse’s

work, whichever is higher.

How much will your survivors get?

Your survivors receive a percentage of your basic Social

Security benet — usually in a range from 75% to 100%

each. However, there is a limit to the amount of money

that can be paid each month to a family. The limit varies

but is generally equal to about 150% to 180% of your

benet rate.

When you’re ready to apply for benets

You should apply for benets about 4 months before the

date you want your benets to start. If you aren’t ready

to apply for retirement benets yet but are thinking about

it, you should visit our website to use our informative

retirement planner at www.ssa.gov/retirement. To le for

disability or survivors’ benets, you should apply as soon

as you’re eligible.

You can nd out the best way to apply for benets at

www.ssa.gov/apply.

If you have a personal my Social Security account, you

can get an estimate of your personal retirement benets.

This will let you see the effects of different ages at which

you may want to begin receiving retirement benets. If

you don’t have a personal my Social Security account,

create one at www.ssa.gov/myaccount.

What you will need to apply

When you apply for benets, we will ask you to provide

certain documents. The documents you’ll need depend on

the type of benets you le for. Provide these documents

15

to us quickly to help us pay your benets faster. You must

present original documents or copies certied by the

issuing ofce — we can’t accept photocopies.

Don’t delay ling an application just because you

don’t have all the documents you need. We’ll help you

get them.

Some documents you may need when you sign up for

Social Security are:

• Your Social Security card (or a record of your number).

• Your birth certicate.

• Your children’s birth certicates and Social Security

numbers (if you’re applying for them).

• Proof of U.S. citizenship or lawful immigration status if

you (or a child) weren’t born in the United States.

• Your spouse’s birth certicate and Social Security

number if they’re applying for benets based on

your earnings.

• Your marriage certicate (if signing up on a

spouse’s earnings or if your spouse is signing up on

your earnings).

• Your military discharge papers if you had

military service.

• Your most recent W-2 form, or your tax return, if you’re

self-employed.

We will let you know if you need other documents when

you apply.

How we pay benets

You must receive your Social Security payments

electronically. One way you can choose to receive

your benets is through direct deposit to your account

at a nancial institution. Direct deposit is a simple and

secure way to receive your payments. Be sure to have

your checkbook or account statement with you when

16

you apply. We will need that information, as well as your

nancial institution’s routing number, to make sure your

monthly benet deposit goes into the right account.

If you don’t have an account with a nancial institution,

or if you prefer to receive your benets on a prepaid

debit card, you can sign up for the Direct Express

®

card

program. Direct Express

®

payments go directly to the

card account. Another payment choice is an electronic

transfer account. This low-cost federally insured

account lets you enjoy the security and convenience of

automatic payments.

Supplemental Security Income (SSI) program

If you have limited income and resources (things you

own), SSI may be able to help. SSI funding comes from

general revenues, not Social Security taxes.

SSI makes monthly payments to people who are age 65

or older or who are blind or have a qualifying disability.

Your income and the things you own affect eligibility for

SSI. We don’t count some of your income and some of

your resources when we decide whether you’re eligible for

SSI. Your house and your car, for example, usually don’t

count as resources. We do count cash, bank accounts,

stocks, and bonds.

How do you apply for SSI?

Visit our SSI webpage at www.ssa.gov/benets/ssi to

begin the application process online.

The online process takes about 5 to 10 minutes, and

no documentation is required to start. Once you provide

some basic information and answer a few questions,

we will schedule an appointment to help you apply

for benets.

17

If you cannot apply online, you can call us toll-free at

1-800-772-1213 (TTY 1-800-325-0778) or your local

Social Security ofce to schedule an appointment

to apply.

Right to appeal

If you disagree with a decision made on your

claim, you can appeal it. You can handle your own

appeal with free help from us, or you can choose to

have a representative help you. We can give you

information about organizations that can help you

nd a representative. For more information about the

appeals process and selecting a representative, read

Your Right to Question the Decision Made on Your Claim

(Publication No. 05-10058).

Online personal “my Social Security” account

You can now easily create a personal my Social Security

account online to check your earnings and get benet

estimates. You may also use your secure

my Social Security account to request a replacement

Social Security number card (available in many states and

the District of Columbia). If you currently receive benets,

you can also:

• Change your address and phone number (Social

Security beneciaries only).

• Get an instant benet verication letter.

• Request a replacement Medicare card.

• Get a replacement SSA-1099 or SSA-1042S for

tax season.

18

• Start or change your direct deposit (Social Security

beneciaries only).

• Opt out of receiving agency notices by mail for those

available online.

• View your appointed representative.

• Report your wages if you work and receive Social

Security disability benets, SSI payments, or both.

You can create a personal my Social Security account

if you’re age 18 or older and have a Social Security

number and a valid email address. To create an account,

go to www.ssa.gov/myaccount. You will need to

create an account with one of our credential service

providers, Login.gov or ID.me, and follow the prompts

for next steps. If you live outside of the U.S., you can

access your personal my Social Security account with an

ID.me credential.

Medicare

Medicare is our country’s basic health insurance

program for people age 65 or older and for many people

with disabilities.

You shouldn’t confuse Medicare with Medicaid. Medicaid

is a health care program for people with low income

and limited resources. State health and human services

ofces or social services agencies run the Medicaid

program. Some people may be eligible for just one

program, while others may be eligible for both Medicare

and Medicaid.

Parts of Medicare

Social Security enrolls you in Original Medicare (Part A

and Part B).

• Medicare Part A (hospital insurance) helps pay for

inpatient care in a hospital or limited time at a skilled

19

nursing facility (following a hospital stay). Part A also

pays for some home health care and hospice care.

• Medicare Part B (medical insurance) helps pay for

services from doctors and other health care providers,

outpatient care, home health care, durable medical

equipment, and some preventive services.

• Medicare Advantage Plan (previously known as Part

C) includes all benets and services covered under

Part A and Part B — prescription drugs and additional

benets such as vision, hearing, and dental — bundled

together in one plan.

• Medicare Part D (Medicare prescription drug coverage)

helps cover the cost of prescription drugs.

Who’s eligible for Medicare Part A?

Most people get Part A when they turn 65. You are

eligible for it automatically if you’re eligible for Social

Security or Railroad Retirement Board benets. Or, you

may be eligible based on a spouse’s (including a divorced

spouse’s) work. Others are eligible because they’re

government employees not covered by Social Security,

but who paid the Medicare tax.

If you get Social Security disability benets for 24 months,

you’re eligible for Part A.

If you get Social Security disability benets because you

have amyotrophic lateral sclerosis (Lou Gehrig’s disease),

you don’t have to wait 24 months to be eligible.

Also, someone with permanent kidney failure requiring

dialysis or kidney replacement qualies for Part A if

they’ve worked long enough or are the spouse or child of

a worker who is eligible.

If you don’t meet these requirements, you may be able

to get Medicare hospital insurance if you pay a monthly

premium. For more information, call our toll-free number

or visit Medicare.gov.

20

Certain people who were exposed to environmental health

hazards are entitled to Part A and can enroll in Part B and

Part D. These people have an asbestos-related disease

and were present for at least 6 months in Lincoln County,

Montana, 10 years or more before diagnosis.

Who’s eligible for Medicare Part B?

Almost every person eligible for Part A can get Part B.

Part B is optional and you usually pay a monthly premium.

In 2024, the standard monthly premium is $174.70. Some

people with higher incomes pay higher premiums.

Medicare Advantage plans

Anyone who has Medicare Part A and Part B can join

a Medicare Advantage plan. Medicare Advantage

plans include:

• Health Maintenance Organization (HMO) plans.

• Preferred Provider Organization (PPO) plans.

• Private Fee-for-Service (PFFS) plans.

• Special Needs Plans (SNPs).

In addition to your Medicare Part B premium, you might

have to pay another monthly premium because of the

extra benets the Medicare Advantage plan offers.

Who can get Medicare Part D?

Anyone who has Original Medicare (Part A or Part B) is

eligible for Medicare prescription drug coverage

(Part D). Part D benets are available as a stand-alone

plan or built into Medicare Advantage, unless you have

a Medicare private fee-for-service (PFFS) plan. The drug

benets work the same in either plan. Joining a Medicare

prescription drug plan is voluntary and you will pay an

extra monthly premium for the coverage.

21

When should I apply for Medicare?

If you’re not already getting benets, you should contact

us about 3 months before your 65th birthday to sign up

for Medicare. You should sign up for Medicare even if you

don’t plan to retire at age 65.

If you’re already getting Social Security benets or

Railroad Retirement Board payments, we’ll contact you

a few months before you become eligible for Medicare

and send you information. If you live in one of the 50

states, Washington, D.C., the Northern Mariana Islands,

Guam, American Samoa, or the U.S. Virgin Islands,

we’ll automatically enroll you in Medicare Parts A and B.

However, because you must pay a premium for Part B

coverage, you can choose to turn it down.

We will not automatically enroll you in a Medicare

prescription drug plan (Part D). Part D is optional and you

must elect this coverage. For the latest information about

Medicare, visit Medicare.gov or call 1-800-MEDICARE

(1-800-633-4227) or TTY number, 1-877-486-2048 if

you’re deaf or hard of hearing.

NOTE: If you don’t enroll in Part B and Part D when

you’re 1

st

eligible, you may have to pay a late enrollment

penalty for as long as you have Part B and Part D

coverage. Also, you may have to wait to enroll, which will

delay coverage.

Residents of Puerto Rico or foreign countries won’t

receive Part B automatically. They must elect

this benet. For more information, read Medicare

(Publication No. 05-10043).

If you have a Health Savings Account (HSA)

If you have an HSA when you sign up for Medicare,

you can’t contribute to your HSA once your Medicare

coverage begins. If you contribute to your HSA after your

Medicare coverage starts, you may have to pay a tax

22

penalty. If you’d like to continue contributing to your HSA,

you shouldn’t apply for Medicare, Social Security, or

Railroad Retirement Board (RRB) benets.

NOTE: Premium-free Part A coverage begins 6 months

back from the date you apply for Medicare (or Social

Security/RRB benets), but no earlier than the 1

st

month

you were eligible for Medicare. To avoid a tax penalty,

you should stop contributing to your HSA at least 6

months before you apply for Medicare.

“Extra Help” with Medicare prescription

drug costs

If you have limited resources and income, you may qualify

for Extra Help to pay for your prescription drugs under

Medicare Part D. Our role is to help you understand how

you may qualify and to process your application for

Extra Help. To see if you qualify or to apply, call our

toll-free number or visit www.ssa.gov/extrahelp.

Help with other Medicare costs

If you have limited income and few resources, your state

may pay your Medicare premiums and, in some cases,

other “out-of-pocket” medical expenses. These may

include deductibles, copayments, and coinsurance.

Only your state can decide whether you qualify for

help under this program. If you think you qualify,

contact your Medicaid, social services, or health and

human services ofce. Visit Medicare.gov/contacts

or call 1-800-MEDICARE (1-800-633-4227; TTY:

1-877-486-2048) to get their number.

Some facts about Social Security

Estimated average 2024 monthly Social Security

benets

• All retired workers: $1,907.

23

• Retired workers with only an aged spouse: $3,033.

• Workers with a disability: $1,537.

• Workers with a disability with a young spouse and 1 or

more children: $2,720.

• Aged surviving spouses without a child: $1,773.

• Young surviving spouses with 2 children: $3,653.

2024 monthly federal SSI maximum payment

rates

(Doesn’t include state supplement, if any)

• $943 for an individual.

• $1,415 for a couple.

Contacting Us

There are several ways to contact us, such as online,

by phone, and in person. We’re here to answer your

questions and to serve you. For nearly 90 years, we have

helped secure today and tomorrow by providing benets

and nancial protection for millions of people throughout

their life’s journey.

Visit our website

The most convenient way to conduct business with us is

online at www.ssa.gov. You can accomplish a lot.

• Apply for Extra Help with Medicare prescription drug

plan costs.

• Apply for most types of benets.

• Start or complete your request for an original or

replacement Social Security card.

• Find copies of our publications.

• Get answers to frequently asked questions.

24

When you create a personal my Social Security account,

you can do even more.

• Review your Social Security Statement.

• Verify your earnings.

• Get estimates of future benets.

• Print a benet verication letter.

• Change your direct deposit information (Social Security

beneciaries only).

• Get a replacement SSA-1099/1042S.

Access to your personal my Social Security account may

be limited for users outside the United States.

Call us

If you cannot use our online services, we can help you by

phone when you call our National toll-free 800 Number.

We provide free interpreter services upon request.

You can call us at 1-800-772-1213 — or at our TTY

number, 1-800-325-0778, if you’re deaf or hard of hearing

— between 8:00 a.m. – 7:00 p.m., Monday through

Friday. For quicker access to a representative, try calling

early in the day (between 8 a.m. and 10 a.m. local time)

or later in the day. We are less busy later in the week

(Wednesday to Friday) and later in the month. We

also offer many automated telephone services, available

24 hours a day, so you may not need to speak with

a representative.

If you have documents we need to see, they must be

original or copies that are certied by the issuing agency.

25

Notes

26

Notes

Social Security Administration | Publication No. 05-10024

January 2024 (Recycle prior editions)

Understanding the Benefits

Produced and published at U.S. taxpayer expense