Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10

Draft Ok to Print

AH XSL/XML

Fileid: … tions/p915/2023/a/xml/cycle02/source (Init. & Date) _______

Page 1 of 33 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Publication 915

Cat. No. 15320P

Social

Security

and

Equivalent

Railroad

Retirement

Benefits

For use in preparing

2023 Returns

Get forms and other information faster and easier at:

• IRS.gov (English)

• IRS.gov/Spanish (Español)

•

IRS.gov/Chinese (中文)

•

IRS.gov/Korean (한국어)

• IRS.gov/Russian (Pусский)

• IRS.gov/Vietnamese (Tiếng Việt)

Contents

Future Developments ....................... 1

Reminders ............................... 1

Introduction .............................. 2

Are Any of Your Benefits Taxable? ............. 3

How To Report Your Benefits ................. 6

How Much Is Taxable? ...................... 6

Lump-Sum Election ....................... 11

Deductions Related to Your Benefits .......... 15

Worksheets ............................. 15

Appendix ............................... 20

How To Get Tax Help ....................... 29

Index .................................. 33

Future Developments

For the latest information about developments related to

Pub. 915, such as legislation enacted after it was

published, go to IRS.gov/Pub915.

Reminders

Filing status name changed to qualifying surviving

spouse. The filing status qualifying widow(er) is now

called qualifying surviving spouse. The rules for the filing

status have not changed. The same rules that applied for

qualifying widow(er) apply to qualifying surviving spouse.

See Qualifying Surviving Spouse in the Instructions for

Form 1040 for details.

Lines 1a through 1z on Forms 1040 and 1040-SR.

Line 1 is expanded and there are lines 1a through 1z.

Some amounts that in prior years were reported on Form

1040 and Form 1040-SR, are now reported on Schedule 1

(Form 1040).

•

Scholarships and fellowship grants are now reported

on Schedule 1, line 8r.

•

Pension or annuity from a nonqualified deferred com-

pensation plan or a nongovernmental section 457 plan

is now reported on Schedule 1, line 8t.

•

Wages earned while incarcerated are now reported on

Schedule 1, line 8u.

Line 6c on Forms 1040 and 1040-SR. A checkbox was

added on line 6c. Taxpayers who elect to use the

lump-sum election method for their benefits will check this

box. See Lump-Sum Election, later.

Nov 30, 2023

Page 2 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

my Social Security account. Social security beneficia-

ries may quickly and easily obtain information from the So-

cial Security Administration's (SSA's) website with a my

Social Security account to:

•

Keep track of your earnings and verify them every

year,

•

Get an estimate of your future benefits if you are still

working,

•

Get a letter with proof of your benefits if you currently

receive them,

•

Change your address,

•

Start or change your direct deposit,

•

Get a replacement Medicare card, and

•

Get a replacement Form SSA-1099 or SSA-1042S for

the tax season.

For more information and to set up an account, go to

SSA.gov/myaccount.

Photographs of missing children. The IRS is a proud

partner with the National Center for Missing & Exploited

Children® (NCMEC). Photographs of missing children se-

lected by the Center may appear in this publication on pa-

ges that would otherwise be blank. You can help bring

these children home by looking at the photographs and

calling 1-800-THE-LOST (1-800-843-5678) if you recog-

nize a child.

Introduction

This publication explains the federal income tax rules for

social security benefits and equivalent tier 1 railroad retire-

ment benefits. It is prepared through the joint efforts of the

IRS, the Social Security Administration (SSA), and the

U.S. Railroad Retirement Board (RRB).

Social security benefits include monthly retirement, sur-

vivor, and disability benefits. They don’t include Supple-

mental Security Income (SSI) payments, which aren’t tax-

able.

Equivalent tier 1 railroad retirement benefits are the part

of tier 1 benefits that a railroad employee or beneficiary

would have been entitled to receive under the social se-

curity system. They are commonly called the social secur-

ity equivalent benefit (SSEB) portion of tier 1 benefits.

If you received these benefits during 2023, you should

have received a Form SSA-1099, Social Security Benefit

Statement; Form RRB-1099, Payments by the Railroad

Retirement Board; Form SSA-1042S, Social Security Ben-

efit Statement; or Form RRB-1042S, Statement for Non-

resident Alien Recipients of Payments by the Railroad Re-

tirement Board, showing the amount.

Note. When the term “benefits” is used in this publica-

tion, it applies to both social security benefits and the

SSEB portion of tier 1 railroad retirement benefits.

What is covered in this publication. This publication

covers the following topics.

•

Whether any of your benefits are taxable.

•

How to report taxable benefits.

•

How much is taxable.

•

How to treat lump-sum benefit payments.

•

Deductions related to your benefits, including a de-

duction or credit you can claim if your repayments are

more than your gross benefits.

The Appendix near the end of this publication explains

items shown on your Form SSA-1099, SSA-1042S,

RRB-1099, or RRB-1042S.

What isn’t covered in this publication. This publication

doesn’t cover the tax rules for the following railroad retire-

ment benefits.

•

Non-social security equivalent benefit (NSSEB) por-

tion of tier 1 benefits.

•

Tier 2 benefits.

•

Vested dual benefits.

•

Supplemental annuity benefits.

For information on these taxable pension benefits, see

Pub. 575, Pension and Annuity Income.

This publication also doesn’t cover the tax rules for for-

eign social security benefits. These benefits are taxable

as annuities, unless they are exempt from U.S. tax or trea-

ted as a U.S. social security benefit under a tax treaty.

Comments and suggestions. We welcome your com-

ments about this publication and suggestions for future

editions.

You can send us comments through IRS.gov/

FormComments. Or, you can write to the Internal Revenue

Service, Tax Forms and Publications, 1111 Constitution

Ave. NW, IR-6526, Washington, DC 20224.

Although we can’t respond individually to each com-

ment received, we do appreciate your feedback and will

consider your comments and suggestions as we revise

our tax forms, instructions, and publications. Don’t send

tax questions, tax returns, or payments to the above ad-

dress.

Getting answers to your tax questions. If you have

a tax question not answered by this publication or the How

To Get Tax Help section at the end of this publication, go

to the IRS Interactive Tax Assistant page at IRS.gov/

Help/ITA where you can find topics by using the search

feature or viewing the categories listed.

Getting tax forms, instructions, and publications.

Go to IRS.gov/Forms to download current and prior-year

forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

Go to IRS.gov/OrderForms to order current forms, instruc-

tions, and publications; call 800-829-3676 to order

prior-year forms and instructions. The IRS will process

your order for forms and publications as soon as possible.

Don’t resubmit requests you’ve already sent us. You can

get forms and publications faster online.

Page 2 Publication 915 (2023)

Page 3 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Useful Items

You may want to see:

Publication

501 Dependents, Standard Deduction, and Filing

Information

505 Tax Withholding and Estimated Tax

519 U.S. Tax Guide for Aliens

575 Pension and Annuity Income

590-A Contributions to Individual Retirement

Arrangements (IRAs)

Form (and Instructions)

1040-ES Estimated Tax for Individuals

SSA-1099 Social Security Benefit Statement

RRB-1099 Payments by the Railroad Retirement

Board

W-4V Voluntary Withholding Request

See How To Get Tax Help at the end of this publication for

information about getting these publications and forms.

Are Any of Your Benefits

Taxable?

To find out whether any of your benefits shown on Forms

SSA-1099 and RRB-1099 may be taxable, compare the

base amount (explained later) for your filing status with the

total of:

1. One-half of your benefits; plus

2. All your other income, including tax-exempt interest.

Exclusions. When making this comparison, don’t reduce

your other income by any exclusions for:

•

Interest from qualified U.S. savings bonds,

•

Employer-provided adoption benefits,

•

Interest on education loans,

•

Foreign earned income or foreign housing, or

•

Income earned by bona fide residents of American

Samoa or Puerto Rico.

Children's benefits. The rules in this publication apply to

benefits received by children. See Who is taxed, later.

The SSA issues Forms SSA-1099 and

SSA-1042S. The RRB issues Forms RRB-1099

and RRB-1042S. These forms (tax statements)

501

505

519

575

590-A

1040-ES

SSA-1099

RRB-1099

W-4V

TIP

report the amounts paid and repaid, and taxes withheld for

a tax year. You may receive more than one of these forms

for the same tax year. See the Appendix, later, for more in-

formation.

Each original Form RRB-1099 or RRB-1042S is valid un-

less it has been corrected. The RRB will issue a corrected

Form RRB-1099 or RRB-1042S if there is an error in the

original. A corrected Form RRB-1099 or RRB-1042S is in-

dicated as “CORRECTED” and replaces the correspond-

ing original Form RRB-1099 or RRB-1042S. You must use

the latest corrected Form RRB-1099 or RRB-1042S you

received and any original Form RRB-1099 or RRB-1042S

that the RRB hasn’t corrected when you determine what

amounts to report on your tax return.

Figuring total income. To figure the total of one-half of

your benefits plus your other income, use Worksheet A,

discussed later. If the total is more than your base amount,

part of your benefits may be taxable.

If you are married and file a joint return for 2023, you

and your spouse must combine your incomes and your

benefits to figure whether any of your combined benefits

are taxable. Even if your spouse didn’t receive any bene-

fits, you must add your spouse's income to yours to figure

whether any of your benefits are taxable.

If the only income you received during 2023 was

your social security or the SSEB portion of tier 1

railroad retirement benefits, your benefits gener-

ally aren’t taxable and you probably don’t have to file a re-

turn. If you have income in addition to your benefits, you

may have to file a return even if none of your benefits are

taxable. See Pub. 501 or your tax return instructions to

find out if you have to file a return.

Base amount. Your base amount is:

•

$25,000 if you are single, head of household, or quali-

fying surviving spouse;

•

$25,000 if you are married filing separately and lived

apart from your spouse for all of 2023;

•

$32,000 if you are married filing jointly; or

•

$0 if you are married filing separately and lived with

your spouse at any time during 2023.

Worksheet A. You can use Worksheet A to figure the

amount of income to compare with your base amount.

This is a quick way to check whether some of your bene-

fits may be taxable.

TIP

Publication 915 (2023) Page 3

Page 4 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

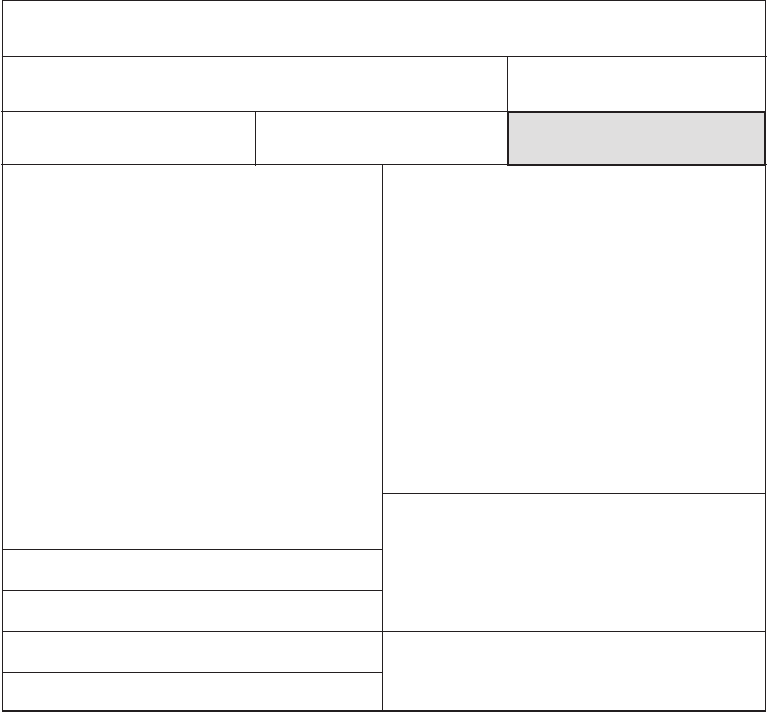

Example. You and your spouse (both over age 65) are filing a joint return for 2023 and you both received social

security benefits during the year. In January 2024, you received a Form SSA-1099 showing net benefits of $1,500 in

box 5. Your spouse received a Form SSA-1099 showing net benefits of $700 in box 5. You also received a taxable

pension of $30,100 and interest income of $700. You didn’t have any tax-exempt interest income. Your benefits aren’t

taxable for 2023 because your income, as figured on Worksheet A, isn’t more than your base amount ($32,000) for

married filing jointly.

Even though none of your benefits are taxable, you must file a return for 2023 because your taxable gross income

($30,800) exceeds the minimum filing requirement amount for your filing status.

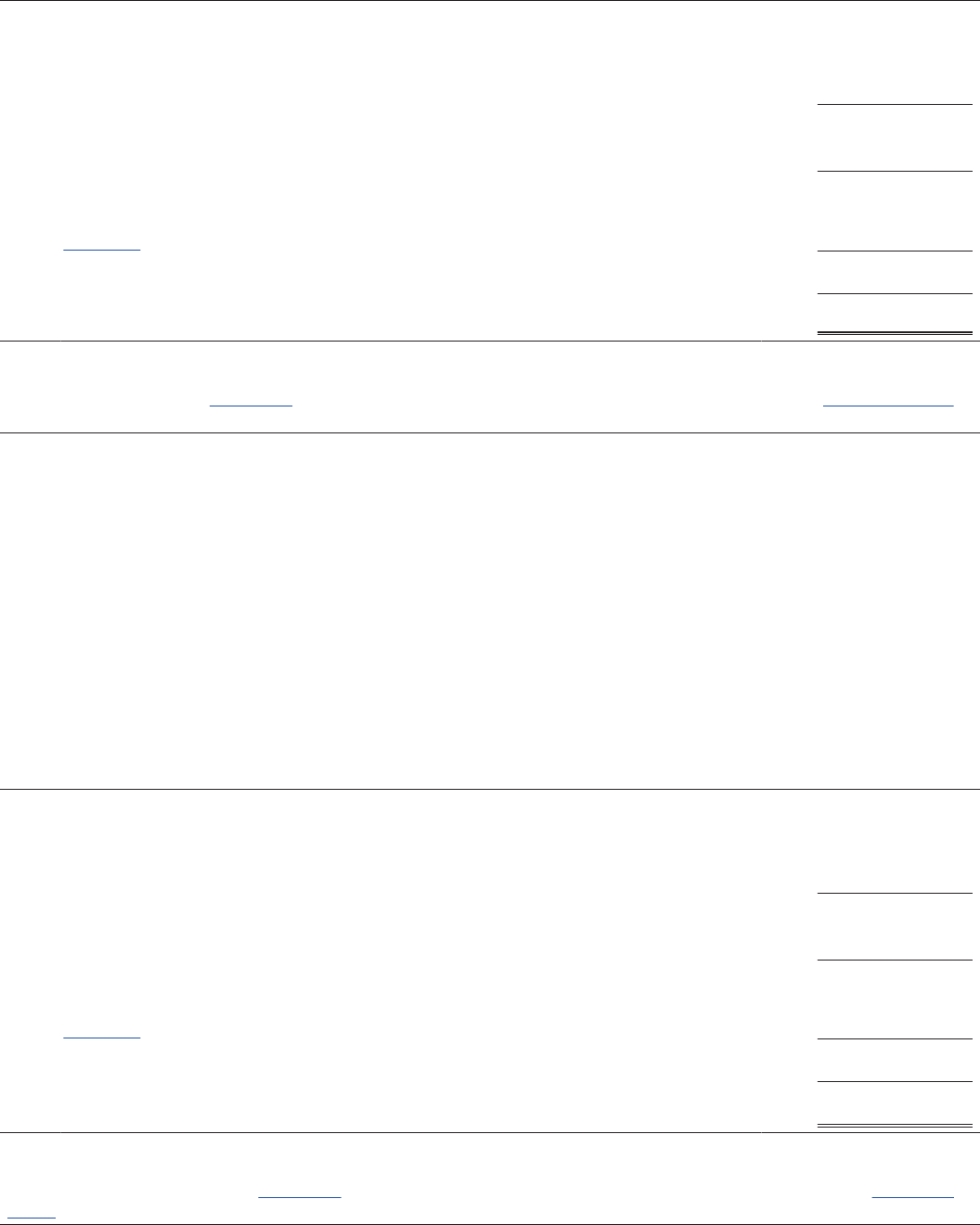

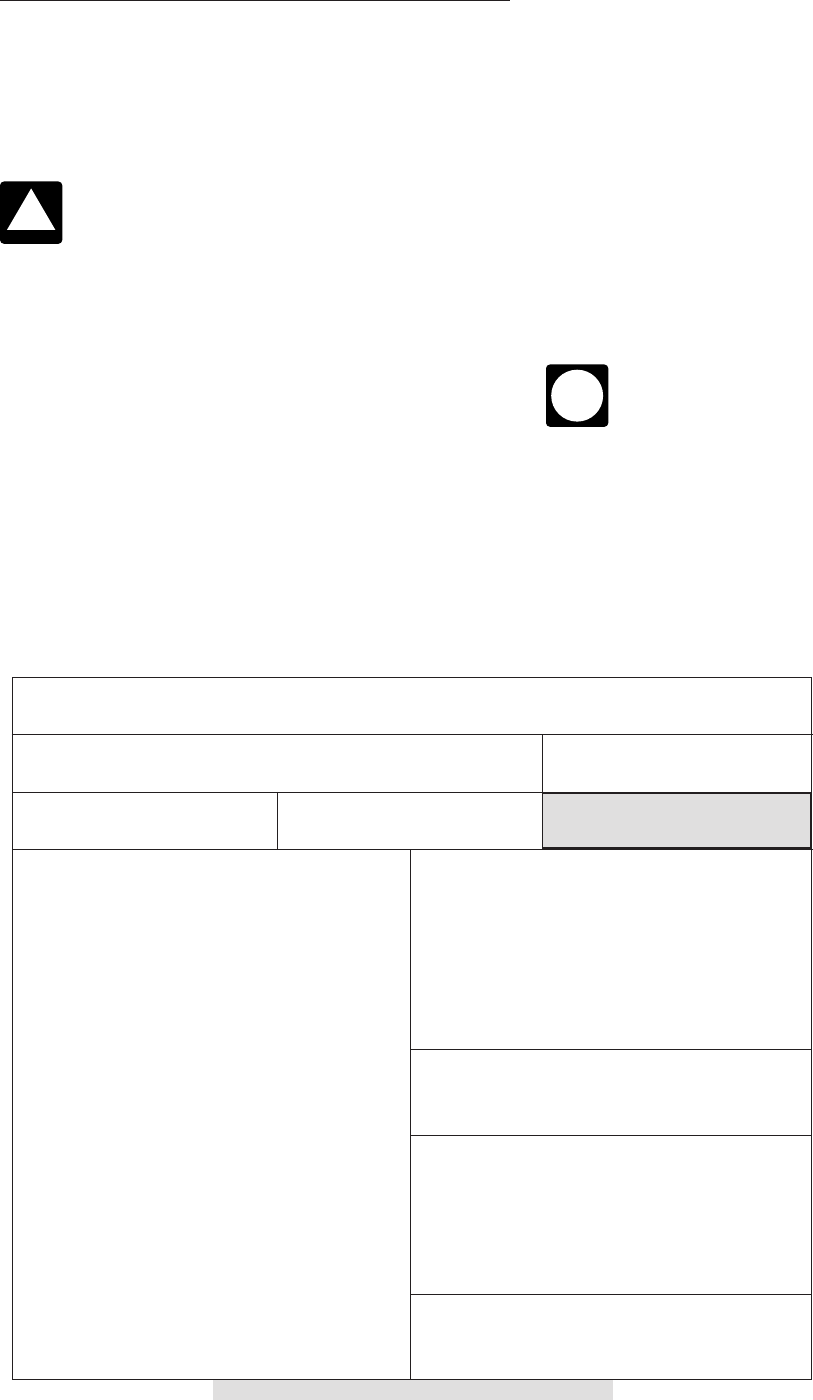

Worksheet A. A Quick Way To Check if Your Benefits May Be Taxable

Note. If you plan to file a joint income tax return, include your spouse's amounts, if any, on lines A, C, and D.

A. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Include the

full amount of any lump-sum benefit payments received in 2023, for 2023 and earlier years. (If

you received more than one form, combine the amounts from box 5 and enter the total.) ..... A.

Note. If the amount on line A is zero or less, stop here; none of your benefits are taxable this year.

B. Multiply line A by 50% (0.50) ......................................................

B.

C. Enter your total income that is taxable (excluding line A), such as pensions, wages, interest,

ordinary dividends, and capital gain distributions. Don’t reduce your income by any deductions,

exclusions (listed earlier), or exemptions ............................................ C.

D. Enter any tax-exempt interest income, such as interest on municipal bonds ...............

D.

E. Add lines B, C, and D ............................................................ E.

Note. Compare the amount on line E to your base amount for your filing status. If the amount on line E equals or is less than the base amount for

your filing status, none of your benefits are taxable this year. If the amount on line E is more than your base amount, some of your benefits may be

taxable. You need to complete Worksheet 1. If none of your benefits are taxable, but you must otherwise file a tax return, see Benefits not taxable,

later, under How To Report Your Benefits.

Filled-in Worksheet A. A Quick Way To Check if Your Benefits May Be Taxable

Note. If you plan to file a joint income tax return, include your spouse's amounts, if any, on lines A, C, and D.

A. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Include the

full amount of any lump-sum benefit payments received in 2023, for 2023 and earlier years. (If

you received more than one form, combine the amounts from box 5 and enter the total.) ..... A.

$2,200

Note. If the amount on line A is zero or less, stop here; none of your benefits are taxable this year.

B. Multiply line A by 50% (0.50) ......................................................

B.

1,100

C. Enter your total income that is taxable (excluding line A), such as pensions, wages, interest,

ordinary dividends, and capital gain distributions. Don’t reduce your income by any deductions,

exclusions (listed earlier), or exemptions ............................................ C.

30,800

D. Enter any tax-exempt interest income, such as interest on municipal bonds ...............

D.

-0-

E. Add lines B, C, and D ............................................................

E.

$31,900

Note. Compare the amount on line E to your base amount for your filing status. If the amount on line E equals or is less than the base amount for

your filing status, none of your benefits are taxable this year. If the amount on line E is more than your base amount, some of your benefits may be

taxable and you will need to complete Worksheet 1. If none of your benefits are taxable, but you must otherwise file a tax return, see Benefits not

taxable, later, under How To Report Your Benefits.

Page 4 Publication 915 (2023)

Page 5 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Who is taxed. Benefits are included in the taxable in-

come (to the extent they are taxable) of the person who

has the legal right to receive the benefits. For example, if

you and your child receive benefits, but the check for your

child is made out in your name, you must use only your

part of the benefits to see whether any benefits are taxa-

ble to you. One-half of the part that belongs to your child

must be added to your child's other income to see

whether any of those benefits are taxable to your child.

Repayment of benefits. Any repayment of benefits you

made during 2023 must be subtracted from the gross ben-

efits you received in 2023. It doesn’t matter whether the

repayment was for a benefit you received in 2023 or in an

earlier year. If you repaid more than the gross benefits you

received in 2023, see Repayments More Than Gross Ben-

efits, later.

Your gross benefits are shown in box 3 of Form

SSA-1099 or RRB-1099. Your repayments are shown in

box 4. The amount in box 5 shows your net benefits for

2023 (box 3 minus box 4). Use the amount in box 5 to fig-

ure whether any of your benefits are taxable.

Example. In 2022, you received $3,000 in social se-

curity benefits, and in 2023 you received $2,700. In March

2023, the SSA notified you that you should have received

only $2,500 in benefits in 2022. During 2023, you repaid

$500 to the SSA. The Form SSA-1099 you received for

2023 shows $2,700 in box 3 (gross amount) and $500 in

box 4 (repayment). The amount in box 5 shows your net

benefits of $2,200 ($2,700 minus $500).

Tax withholding and estimated tax. You can choose to

have federal income tax withheld from your social security

benefits and/or the SSEB portion of your tier 1 railroad re-

tirement benefits. If you choose to do this, you must com-

plete a Form W-4V.

If you don’t choose to have income tax withheld, you

may have to request additional withholding from other in-

come or pay estimated tax during the year. For details,

see Pub. 505, or the Instructions for Form 1040-ES.

U.S. citizens residing abroad. U.S. citizens who are

residents of the following countries are exempt from U.S.

tax on their benefits.

•

Canada.

•

Egypt.

•

Germany.

•

Ireland.

•

Israel.

•

Italy. (You must also be a citizen of Italy for the exemp-

tion to apply.)

•

Romania.

•

United Kingdom.

The SSA won’t withhold U.S. tax from your benefits if

you are a U.S. citizen.

The RRB will withhold U.S. tax from your benefits un-

less you file Form RRB-1001, Nonresident Questionnaire,

with the RRB to provide citizenship and residency infor-

mation. If you don’t file Form RRB-1001, the RRB will con-

sider you a nonresident alien and withhold tax from your

railroad retirement benefits at a 30% rate. Contact the

RRB to get this form.

Lawful permanent residents. For U.S. income tax pur-

poses, lawful permanent residents (green card holders)

are considered resident aliens until their lawful permanent

resident status under the immigration laws is either taken

away or is administratively or judicially determined to have

been abandoned. Social security benefits paid to a green

card holder are not subject to 30% withholding. If you are

a green card holder and tax was withheld in error on your

social security benefits because you have a foreign ad-

dress, the withholding tax is refundable by the SSA or the

IRS. The SSA will refund taxes erroneously withheld if the

refund can be processed during the same calendar year in

which the tax was withheld. If the SSA can’t refund the

taxes withheld, you must file a Form 1040 or 1040-SR with

the Internal Revenue Service Center, Austin, TX 73301, to

determine if you are entitled to a refund. You must also at-

tach the following information to your Form 1040 or

1040-SR.

•

A copy of the Form SSA-1042S.

•

A copy of the “green card” unless you are a bona fide

resident of American Samoa.

•

A signed declaration that includes the following state-

ments:

“The SSA should not have withheld federal income tax

from my social security benefits because I am a U.S. law-

ful permanent resident and my green card has been nei-

ther revoked nor administratively or judicially determined

to have been abandoned. I am filing a U.S. income tax re-

turn for the tax year as a resident alien reporting all of my

worldwide income. I have not claimed benefits for the tax

year under an income tax treaty as a nonresident alien.”

Nonresident aliens. A nonresident alien is an individual

who isn’t a citizen or resident of the United States. If you

are a nonresident alien, the rules discussed in this publi-

cation don’t apply to you. Instead, 85% of your benefits

are taxed at a 30% rate, unless exempt (or subject to a

lower rate) by treaty. You will receive a Form SSA-1042S

or RRB-1042S showing the amount of your benefits.

These forms will also show the tax rate and the amount of

tax withheld from your benefits.

Under tax treaties with the following countries, resi-

dents of these countries are exempt from U.S. tax on their

benefits.

•

Canada.

•

Egypt.

•

Germany.

•

Ireland.

•

Israel.

•

Italy.

•

Japan.

Publication 915 (2023) Page 5

Page 6 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

•

Romania.

•

United Kingdom.

Under a treaty with India, benefits paid to individuals

who are both residents and nationals of India are exempt

from U.S. tax if the benefits are for services performed for

the United States, its subdivisions, or local government

authorities.

If you are a resident of Switzerland, your total benefit

amount will be taxed at a 15% rate.

For more information on whether you are a nonresident

alien, see Pub. 519.

Exemption from withholding. If your social security

benefits are exempt from tax because you are a resident

of one of the treaty countries listed, the SSA won’t with-

hold U.S. tax from your benefits.

If your railroad retirement benefits are exempt from tax

because you are a resident of one of the treaty countries

listed, you can claim an exemption from withholding by fil-

ing Form RRB-1001 with the RRB. Contact the RRB to get

this form.

Canadian or German social security benefits paid to

U.S. residents. Under income tax treaties with Canada

and Germany, social security benefits paid by those coun-

tries to U.S. residents are treated for U.S. income tax pur-

poses as if they were paid under the social security legis-

lation of the United States. If you receive social security

benefits from Canada or Germany, include them on line 1

of Worksheet 1.

How To Report Your Benefits

If part of your benefits are taxable, you must use Form

1040 or 1040-SR.

Reporting on Form 1040 or 1040-SR. Report your net

benefits (the total amount from box 5 of all your Forms

SSA-1099 and RRB-1099) on line 6a and the taxable part

on line 6b. If you are married filing separately and you

lived apart from your spouse for all of 2023, also enter “D”

to the right of the word “benefits” on line 6a.

Benefits not taxable. Report your net benefits (the total

amount from box 5 of all your Forms SSA-1099 and

RRB-1099) on Form 1040 or 1040-SR, line 6a. Enter -0-

on Form 1040 or 1040-SR, line 6b. If you are married filing

separately and you lived apart from your spouse for all of

2023, also enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

How Much Is Taxable?

If part of your benefits are taxable, how much is taxable

depends on the total amount of your benefits and other in-

come. Generally, the higher that total amount, the greater

the taxable part of your benefits.

Maximum taxable part. Generally, up to 50% of your

benefits will be taxable. However, up to 85% of your bene-

fits can be taxable if either of the following situations ap-

plies to you.

•

The total of one-half of your benefits and all your other

income is more than $34,000 ($44,000 if you are mar-

ried filing jointly).

•

You are married filing separately and lived with your

spouse at any time during 2023.

Which worksheet to use. A worksheet you can use to

figure your taxable benefits is in the Instructions for Form

1040. You can use either that worksheet or Worksheet 1 in

this publication, unless any of the following situations ap-

plies to you.

1. You contributed to a traditional individual retirement

arrangement (IRA) and you or your spouse is covered

by a retirement plan at work. In this situation, you must

use the special worksheets in Appendix B of Pub.

590-A to figure both your IRA deduction and your tax-

able benefits.

2. Situation 1 doesn’t apply and you take an exclusion

for interest from qualified U.S. savings bonds (Form

8815), for adoption benefits (Form 8839), for foreign

earned income or housing (Form 2555), or for income

earned in American Samoa (Form 4563) or Puerto

Rico by bona fide residents. In this situation, you must

use Worksheet 1 in this publication to figure your taxa-

ble benefits.

3. You received a lump-sum payment for an earlier year.

In this situation, also complete Worksheet 2 or 3 and

Worksheet 4 in this publication. See Lump-Sum Elec-

tion, later.

Examples

A few examples you can use as a guide to figure the taxa-

ble part of your benefits follow.

Page 6 Publication 915 (2023)

Page 7 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

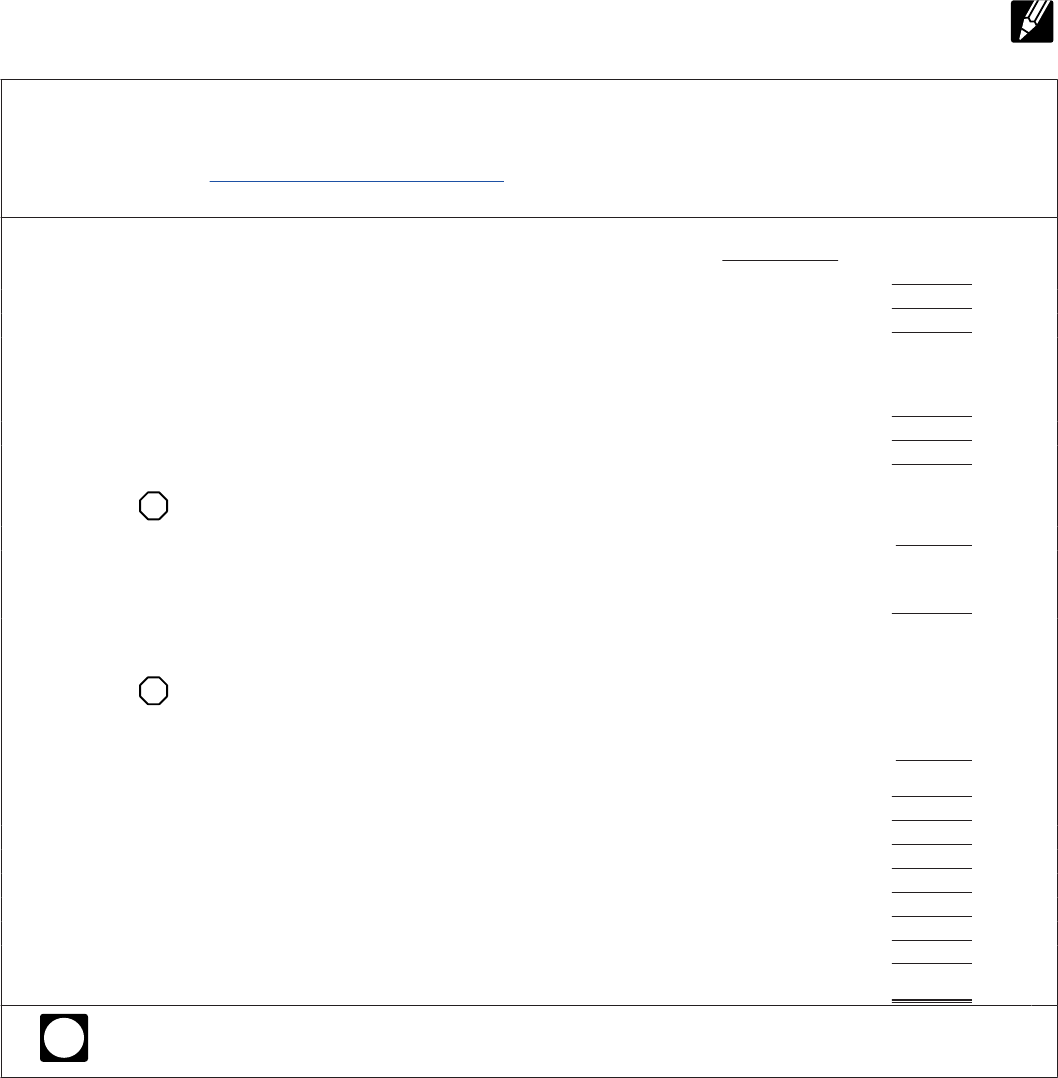

Examples

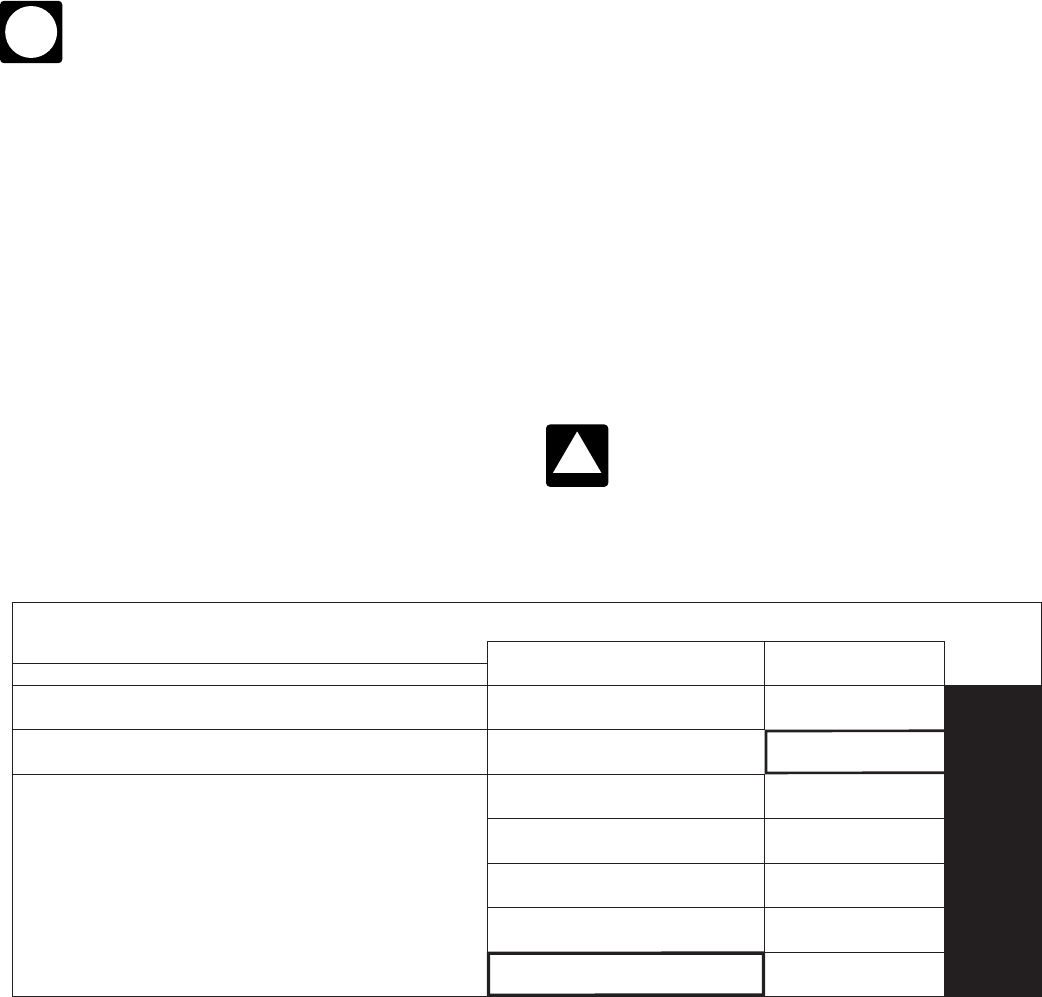

Example 1. George White is single and files Form 1040 for 2023. In addition to receiving social security payments, he

received a fully taxable pension of $18,600, wages from a part-time job of $9,400, and taxable interest income of $990,

for a total of $28,990. He received a Form SSA-1099 in January 2024 that shows his net social security benefits of

$5,980 in box 5.

To figure his taxable benefits, George completes Worksheet 1, shown below. On line 6a of his Form 1040, George

enters his net benefits of $5,980. On line 6b, he enters his taxable benefits of $2,990.

Filled-in Worksheet 1. Figuring Your Taxable Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.

$5,980

2. Multiply line 1 by 50% (0.50) ............................................................

2.

2,990

3. Combine the amounts from Form 1040 or 1040-SR, lines 1z, 2b, 3b, 4b, 5b, 7, and 8 .................

3.

28,990

4. Enter the amount, if any, from Form 1040 or 1040-SR, line 2a ...................................

4.

-0-

5. Enter the total of any exclusions/adjustments for:

•

Adoption benefits (Form 8839, line 28),

•

Foreign earned income or housing (Form 2555, lines 45 and 50), and

•

Certain income of bona fide residents of American Samoa (Form 4563, line 15) or Puerto

Rico ............................................................................ 5.

-0-

6. Combine lines 2, 3, 4, and 5 above .......................................................

6.

31,980

7. Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25 .......

7.

-0-

8. Is the amount on line 7 less than the amount on line 6?

No.

STOP

None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR,

line 6b.

Yes. Subtract line 7 from line 6 ...................................................

8.

31,980

9. If you are:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, or married filing separately and you lived

apart from your spouse for all of 2023, enter $25,000 ...................................... 9.

25,000

Note. If you are married filing separately and you lived with your spouse at any time in 2023, skip lines 9

through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 9 less than the amount on line 8?

No.

STOP

None of your benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you

are married filing separately and you lived apart from your spouse for all of 2023, be

sure you entered “D” to the right of the word “benefits” on Form 1040 or 1040-SR,

line 6a.

Yes. Subtract line 9 from line 8 ...................................................

10.

6,980

11. Enter $12,000 if married filing jointly; or $9,000 if single, head of household, qualifying surviving spouse, or

married filing separately and you lived apart from your spouse for all of 2023 ...................... 11.

9,000

12. Subtract line 11 from line 10. If zero or less, enter -0- .........................................

12.

-0-

13. Enter the smaller of line 10 or line 11 .....................................................

13.

6,980

14. Multiply line 13 by 50% (0.50) ...........................................................

14.

3,490

15. Enter the smaller of line 2 or line 14 ......................................................

15.

2,990

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ......................................

16.

-0-

17. Add lines 15 and 16 ...................................................................

17.

2,990

18. Multiply line 1 by 85% (0.85) ............................................................

18.

5,083

19. Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040 or

1040-SR, line 6b ..................................................................... 19.

$2,990

TIP

If you received a lump-sum payment in 2023 that was for an earlier year, also complete

Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

Publication 915 (2023) Page 7

Page 8 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Example 2. Ray and Alice Hopkins file a joint return on Form 1040 for 2023. Ray is retired and received a fully taxable

pension of $15,500. He also received social security benefits, and his Form SSA-1099 for 2023 shows net benefits of

$5,600 in box 5. Alice worked during the year and had wages of $14,000. She made a deductible payment to her IRA

account of $1,000 and isn’t covered by a retirement plan at work. Ray and Alice have two savings accounts with a total

of $250 in taxable interest income. They complete Worksheet 1, shown below, entering $29,750 ($15,500 + $14,000 +

$250) on line 3. They find none of Ray's social security benefits are taxable. On Form 1040, they enter $5,600 on

line 6a and -0- on line 6b.

Filled-in Worksheet 1. Figuring Your Taxable Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.

$5,600

2. Multiply line 1 by 50% (0.50) ............................................................

2.

2,800

3. Combine the amounts from Form 1040 or 1040-SR, lines 1z, 2b, 3b, 4b, 5b, 7, and 8 .................

3.

29,750

4. Enter the amount, if any, from Form 1040 or 1040-SR, line 2a ...................................

4.

-0-

5. Enter the total of any exclusions/adjustments for:

•

Adoption benefits (Form 8839, line 28),

•

Foreign earned income or housing (Form 2555, lines 45 and 50), and

•

Certain income of bona fide residents of American Samoa (Form 4563, line 15) or Puerto

Rico ............................................................................ 5.

-0-

6. Combine lines 2, 3, 4, and 5 above .......................................................

6.

32,550

7. Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25 .......

7.

1,000

8. Is the amount on line 7 less than the amount on line 6?

No.

STOP

None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR,

line 6b.

Yes. Subtract line 7 from line 6 ...................................................

8.

31,550

9. If you are:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, or married filing separately and you lived

apart from your spouse for all of 2023, enter $25,000 ...................................... 9.

32,000

Note. If you are married filing separately and you lived with your spouse at any time in 2023, skip lines 9

through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 9 less than the amount on line 8?

No.

STOP

None of your benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you

are married filing separately and you lived apart from your spouse for all of 2023, be

sure you entered “D” to the right of the word “benefits” on Form 1040 or 1040-SR,

line 6a.

Yes. Subtract line 9 from line 8 ...................................................

10.

11. Enter $12,000 if married filing jointly; or $9,000 if single, head of household, qualifying surviving spouse, or

married filing separately and you lived apart from your spouse for all of 2023 ...................... 11.

12. Subtract line 11 from line 10. If zero or less, enter -0- .........................................

12.

13. Enter the smaller of line 10 or line 11 .....................................................

13.

14. Multiply line 13 by 50% (0.50) ...........................................................

14.

15. Enter the smaller of line 2 or line 14 ......................................................

15.

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ......................................

16.

17. Add lines 15 and 16 ...................................................................

17.

18. Multiply line 1 by 85% (0.85) ............................................................

18.

19. Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040 or

1040-SR, line 6b ..................................................................... 19.

TIP

If you received a lump-sum payment in 2023 that was for an earlier year, also complete

Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

Page 8 Publication 915 (2023)

Page 9 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Example 3. Joe and Betty Johnson file a joint return on Form 1040 for 2023. Joe is a retired railroad worker and in 2023 received

the SSEB portion of tier 1 railroad retirement benefits. Joe's Form RRB-1099 shows $10,000 in box 5. Betty is a retired government

worker and received a fully taxable pension of $38,000. They had $2,300 in taxable interest income plus interest of $200 on a

qualified U.S. savings bond. The savings bond interest qualified for the exclusion. They figure their taxable benefits by completing

Worksheet 1, shown below. Because they have qualified U.S. savings bond interest, they follow the note at the beginning of the

worksheet and use the amount from line 2 of their Schedule B (Form 1040) on line 3 of the worksheet instead of the amount from

line 2b of their Form 1040. On line 3 of the worksheet, they enter $40,500 ($38,000 + $2,500). More than 50% of Joe's net benefits

are taxable because the income on line 8 of the worksheet ($45,500) is more than $44,000. (See Maximum taxable part under How

Much Is Taxable, earlier.) Joe and Betty enter $10,000 on Form 1040, line 6a; and $6,275 on Form 1040, line 6b.

Filled-in Worksheet 1. Figuring Your Taxable Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.

$10,000

2. Multiply line 1 by 50% (0.50) ............................................................

2.

5,000

3. Combine the amounts from Form 1040 or 1040-SR, lines 1z, 2b, 3b, 4b, 5b, 7, and 8 .................

3.

40,500

4. Enter the amount, if any, from Form 1040 or 1040-SR, line 2a ...................................

4.

-0-

5. Enter the total of any exclusions/adjustments for:

•

Adoption benefits (Form 8839, line 28),

•

Foreign earned income or housing (Form 2555, lines 45 and 50), and

•

Certain income of bona fide residents of American Samoa (Form 4563, line 15) or Puerto

Rico ............................................................................ 5.

-0-

6. Combine lines 2, 3, 4, and 5 above .......................................................

6.

45,500

7. Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25 .......

7.

-0-

8. Is the amount on line 7 less than the amount on line 6?

No.

STOP

None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR,

line 6b.

Yes. Subtract line 7 from line 6 ...................................................

8.

45,500

9. If you are:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, or married filing separately and you lived

apart from your spouse for all of 2023, enter $25,000 ...................................... 9.

32,000

Note. If you are married filing separately and you lived with your spouse at any time in 2023, skip lines 9

through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 9 less than the amount on line 8?

No.

STOP

None of your benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you

are married filing separately and you lived apart from your spouse for all of 2023, be

sure you entered “D” to the right of the word “benefits” on Form 1040 or 1040-SR,

line 6a.

Yes. Subtract line 9 from line 8 ...................................................

10.

13,500

11. Enter $12,000 if married filing jointly; or $9,000 if single, head of household, qualifying surviving spouse, or

married filing separately and you lived apart from your spouse for all of 2023 ...................... 11.

12,000

12. Subtract line 11 from line 10. If zero or less, enter -0- .........................................

12.

1,500

13. Enter the smaller of line 10 or line 11 .....................................................

13.

12,000

14. Multiply line 13 by 50% (0.50) ...........................................................

14.

6,000

15. Enter the smaller of line 2 or line 14 ......................................................

15.

5,000

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ......................................

16.

1,275

17. Add lines 15 and 16 ...................................................................

17.

6,275

18. Multiply line 1 by 85% (0.85) ............................................................

18.

8,500

19. Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040 or

1040-SR, line 6b ..................................................................... 19.

$6,275

TIP

If you received a lump-sum payment in 2023 that was for an earlier year, also complete

Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

Publication 915 (2023) Page 9

Page 10 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Filled-in Worksheet 1. Figuring Your Taxable Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.

$4,000

2. Multiply line 1 by 50% (0.50) ............................................................

2.

2,000

3. Combine the amounts from Form 1040 or 1040-SR, lines 1z, 2b, 3b, 4b, 5b, 7, and 8 .................

3.

8,000

4. Enter the amount, if any, from Form 1040 or 1040-SR, line 2a ...................................

4.

-0-

5. Enter the total of any exclusions/adjustments for:

•

Adoption benefits (Form 8839, line 28),

•

Foreign earned income or housing (Form 2555, lines 45 and 50), and

•

Certain income of bona fide residents of American Samoa (Form 4563, line 15) or Puerto

Rico ............................................................................ 5.

-0-

6. Combine lines 2, 3, 4, and 5 above .......................................................

6.

10,000

7. Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25 ......

7.

-0-

8. Is the amount on line 7 less than the amount on line 6?

No.

STOP

None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR,

line 6b.

Yes. Subtract line 7 from line 6 ...................................................

8.

10,000

9. If you are:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, or married filing separately and you lived

apart from your spouse for all of 2023, enter $25,000 ...................................... 9.

Note. If you are married filing separately and you lived with your spouse at any time in 2023, skip lines 9

through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 9 less than the amount on line 8?

No.

STOP

None of your benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you

are married filing separately and you lived apart from your spouse for all of 2023, be

sure you entered “D” to the right of the word “benefits” on Form 1040 or 1040-SR,

line 6a.

Yes. Subtract line 9 from line 8 ...................................................

10.

11. Enter $12,000 if married filing jointly; or $9,000 if single, head of household, qualifying surviving spouse, or

married filing separately and you lived apart from your spouse for all of 2023 ...................... 11.

12. Subtract line 11 from line 10. If zero or less, enter -0- .........................................

12.

13. Enter the smaller of line 10 or line 11 .....................................................

13.

14. Multiply line 13 by 50% (0.50) ...........................................................

14.

15. Enter the smaller of line 2 or line 14 ......................................................

15.

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ......................................

16.

17. Add lines 15 and 16 ...................................................................

17.

8,500

18. Multiply line 1 by 85% (0.85) ............................................................

18.

3,400

19. Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040 or

1040-SR, line 6b ..................................................................... 19.

$3,400

TIP

If you received a lump-sum payment in 2023 that was for an earlier year, also complete

Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

Example 4. Bill and Eileen Jones are married and live together, but file separate Form 1040 returns for 2023. Bill

earned $8,000 during 2023. The only other income he had for the year was $4,000 net social security benefits (box 5

of his Form SSA-1099). Bill figures his taxable benefits by completing Worksheet 1, shown below. He must include

85% of his social security benefits in his taxable income because he is married filing separately and lived with his

spouse during 2023. See How Much Is Taxable, earlier. Bill enters $4,000 on his Form 1040, line 6a; and $3,400 on

Form 1040, line 6b.

Page 10 Publication 915 (2023)

Page 11 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Lump-Sum Election

You must include the taxable part of a lump-sum (retroac-

tive) payment of benefits received in 2023 in your 2023 in-

come, even if the payment includes benefits for an earlier

year.

Check the box on line 6c if you elect to use the

lump-sum election method for your benefits. If any

of your benefits are taxable for 2023 and they in-

clude a lump-sum benefit payment that was for an earlier

year, you may be able to to reduce the taxable amount

with the lump-sum election.

This type of lump-sum benefit payment shouldn’t

be confused with the lump-sum death benefit that

both the SSA and RRB pay to many of their bene-

ficiaries. No part of the lump-sum death benefit is subject

to tax.

Generally, you use your 2023 income to figure the taxa-

ble part of the total benefits received in 2023. However,

you may be able to figure the taxable part of a lump-sum

payment for an earlier year separately, using your income

for the earlier year. You can elect this method if it lowers

your taxable benefits.

Under the lump-sum election method, you refigure the

taxable part of all your benefits for the earlier year (includ-

ing the lump-sum payment) using that year's income.

Then, you subtract any taxable benefits for that year that

you previously reported. The remainder is the taxable part

of the lump-sum payment. Add it to the taxable part of

your benefits for 2023 (figured without the lump-sum pay-

ment for the earlier year).

Because the earlier year's taxable benefits are in-

cluded in your 2023 income, no adjustment is

made to the earlier year's return. Don’t file an

amended return for the earlier year.

Will the lump-sum election method lower your taxa-

ble benefits? To find out, take the following steps.

1. Complete Worksheet 1 in this publication.

2. Complete Worksheet 2 and Worksheet 3, as appropri-

ate. Use Worksheet 2 if your lump-sum payment was

for a year after 1993. Use Worksheet 3 if it was for

1993 or an earlier year. Complete a separate Work-

sheet 2 or Worksheet 3 for each earlier year for which

you received the lump-sum payment.

3. Complete Worksheet 4.

4. Compare the taxable benefits on line 19 of Worksheet

1 with the taxable benefits on line 21 of Worksheet 4.

If the taxable benefits on Worksheet 4 are lower than the

taxable benefits on Worksheet 1, you can elect to report

the lower amount on your return.

Making the election. If you elect to report your taxable

benefits under the lump-sum election method, follow the

TIP

TIP

CAUTION

!

instructions at the bottom of Worksheet 4. Don’t attach the

completed worksheets to your return. Keep them with your

records.

Once you elect this method of figuring the taxable

part of a lump-sum payment, you can revoke your

election only with the consent of the IRS.

Lump-sum payment reported on Form SSA-1099 or

RRB-1099. If you received a lump-sum payment in 2023

that includes benefits for one or more earlier years after

1983, it will be included in box 3 of either Form SSA-1099

or RRB-1099. That part of any lump-sum payment for

years before 1984 isn’t taxed and won’t be shown on the

form. The form will also show the year (or years) the pay-

ment is for. However, Form RRB-1099 will not show a

breakdown by year (or years) of any lump-sum payment

for years before 2017. You must contact the RRB for a

breakdown by year for any amount shown in box 9.

Example

Jane Jackson is single. In 2022, she applied for social se-

curity disability benefits but was told she was ineligible.

She appealed the decision and won. In 2023, she re-

ceived a lump-sum payment of $6,000, of which $2,000

was for 2022 and $4,000 was for 2023. Jane also received

$5,000 in social security benefits in 2023, so her total ben-

efits in 2023 were $11,000. Jane's other income for 2022

and 2023 is as follows.

Income 2022 2023

Wages $20,000 $3,500

Interest income 2,000 2,500

Dividend income 1,000 1,500

Fully taxable pension 18,000

Total $23,000 $25,500

To see if the lump-sum election method results in lower

taxable benefits, she completes Worksheets 1, 2, and 4

from this publication. She doesn’t need to complete Work-

sheet 3 because her lump-sum payment was for years af-

ter 1993.

Jane completes Worksheet 1 to find the amount of her

taxable benefits for 2023 under the regular method. She

completes Worksheet 2 to find the taxable part of the

lump-sum payment for 2022 under the lump-sum election

method. She completes Worksheet 4 to decide if the

lump-sum election method will lower her taxable benefits.

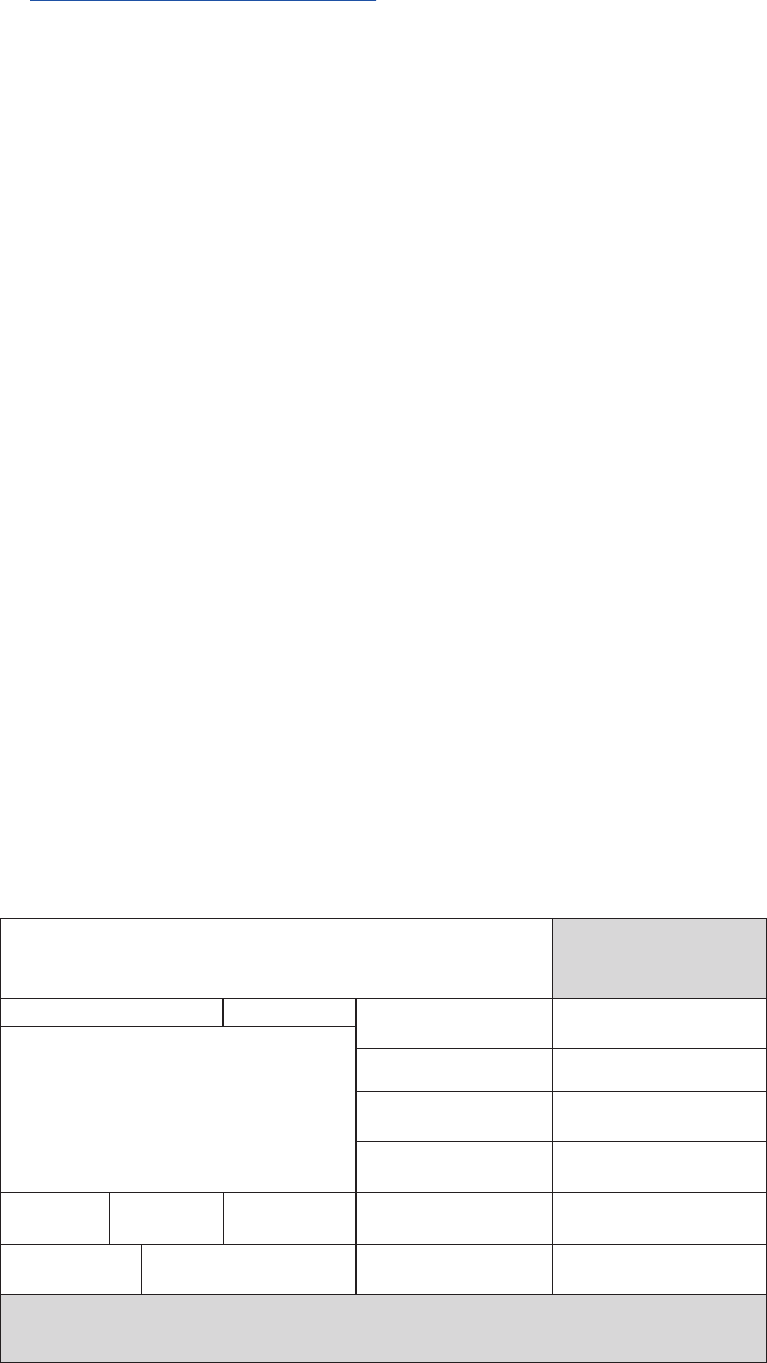

After completing the worksheets, Jane compares the

amounts from Worksheet 4, line 21; and Worksheet 1,

line 19. Because the amount on Worksheet 4 is smaller,

she chooses to use the lump-sum election method. To do

this, she prints “LSE” to the left of Form 1040 or 1040-SR,

line 6a. She then enters $11,000 on Form 1040 or

1040-SR, line 6a, and her taxable benefits of $2,500 on

line 6b.

Jane's filled-in worksheets (1, 2, and 4) follow.

CAUTION

!

Publication 915 (2023) Page 11

Page 12 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Jane Jackson's Filled-in Worksheet 1. Figuring Your Taxable

Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.

$11,000

2. Multiply line 1 by 50% (0.50) ............................................................

2.

5,500

3. Combine the amounts from Form 1040 or 1040-SR, lines 1z, 2b, 3b, 4b, 5b, 7, and 8 .................

3.

25,500

4. Enter the amount, if any, from Form 1040 or 1040-SR, line 2a ...................................

4.

-0-

5. Enter the total of any exclusions/adjustments for:

•

Adoption benefits (Form 8839, line 28),

•

Foreign earned income or housing (Form 2555, lines 45 and 50), and

•

Certain income of bona fide residents of American Samoa (Form 4563, line 15) or Puerto

Rico ............................................................................ 5.

-0-

6. Combine lines 2, 3, 4, and 5 above .......................................................

6.

31,000

7. Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25 .......

7.

-0-

8. Is the amount on line 7 less than the amount on line 6?

No.

STOP

None of your social security benefits are taxable. Enter -0- on Form 1040 or 1040-SR,

line 6b.

Yes. Subtract line 7 from line 6 ...................................................

8.

31,000

9. If you are:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, or married filing separately and you lived

apart from your spouse for all of 2023, enter $25,000 ...................................... 9.

25,000

Note. If you are married filing separately and you lived with your spouse at any time in 2023, skip lines 9

through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 9 less than the amount on line 8?

No.

STOP

None of your benefits are taxable. Enter -0- on Form 1040 or 1040-SR, line 6b. If you

are married filing separately and you lived apart from your spouse for all of 2023, be

sure you entered “D” to the right of the word “benefits” on Form 1040 or 1040-SR,

line 6a.

Yes. Subtract line 9 from line 8 ...................................................

10.

6,000

11. Enter $12,000 if married filing jointly; or $9,000 if single, head of household, qualifying surviving spouse, or

married filing separately and you lived apart from your spouse for all of 2023 ...................... 11.

9,000

12. Subtract line 11 from line 10. If zero or less, enter -0- .........................................

12.

-0-

13. Enter the smaller of line 10 or line 11 .....................................................

13.

6,000

14. Multiply line 13 by 50% (0.50) ...........................................................

14.

3,000

15. Enter the smaller of line 2 or line 14 ......................................................

15.

3,000

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ......................................

16.

-0-

17. Add lines 15 and 16 ...................................................................

17.

3,000

18. Multiply line 1 by 85% (0.85) ............................................................

18.

9,350

19. Taxable benefits. Enter the smaller of line 17 or line 18. Also enter this amount on Form 1040 or

1040-SR, line 6b ..................................................................... 19.

$3,000

TIP

If you received a lump-sum payment in 2023 that was for an earlier year, also complete

Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

Page 12 Publication 915 (2023)

Page 13 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Jane Jackson's Filled-in Worksheet 2. Figure Your Additional

Taxable Benefits (From a Lump-Sum Payment for a Year

After 1993) Keep for Your Records

Enter earlier year 2022

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099 for the earlier

year, plus the lump-sum payment for the earlier year received after that year ................. 1.

$2,000

Note. If line 1 is zero or less, skip lines 2 through 20 and enter -0- on line 21. Otherwise, go to

line 2.

2. Multiply line 1 by 50% (0.50) ..................................................................

2.

1,000

3. Enter your adjusted gross income for the earlier year ...............................................

3.

23,000

4. Enter the total of any exclusions/adjustments you claimed in the earlier year for:

•

Adoption benefits (Form 8839),

•

Qualified U.S. savings bond interest (Form 8815),

•

Student loan interest (Schedule 1 (Form 1040), line 21),

•

Foreign earned income or housing (Form 2555), and

•

Certain income of bona fide residents of American Samoa (Form 4563) or Puerto Rico .................. 4.

-0-

5. Enter any tax-exempt interest received in the earlier year ............................................

5.

-0-

6. Add lines 2 through 5 ........................................................................

6.

24,000

7. Enter your taxable benefits for the earlier year that you previously reported ..............................

7.

-0-

8. Subtract line 7 from line 6 .....................................................................

8.

24,000

9. If, for the earlier year, you were:

•

Married filing jointly, enter $32,000; or

•

Single, head of household, qualifying surviving spouse, married filing separately and you lived apart from

your spouse for all of the earlier year, enter $25,000 ...................... ...................... 9.

25,000

Note. If you were married filing separately and you lived with your spouse at any time during the earlier year, skip

lines 9 through 16, multiply line 8 by 85% (0.85), and enter the result on line 17. Then, go to line 18.

10. Is the amount on line 8 more than the amount on line 9?

No. Skip lines 10 through 20 and enter -0- on line 21.

Yes. Subtract line 9 from line 8 .............................................................

10.

11. Enter $12,000 if married filing jointly for the earlier year; or $9,000 if single, head of household, qualifying

surviving spouse, or married filing separately and you lived apart from your spouse for all of the earlier

year ..................................................................................... 11.

12. Subtract line 11 from line 10. If zero or less, enter -0- ...............................................

12.

13. Enter the smaller of line 10 or line 11 ...........................................................

13.

14. Multiply line 13 by 50% (0.50) .................................................................

14.

15. Enter the smaller of line 2 or line 14 ............................................................

15.

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- ............................................

16.

17. Add lines 15 and 16 .........................................................................

17.

18. Multiply line 1 by 85% (0.85) ..................................................................

18.

19. Refigured taxable benefits. Enter the smaller of line 17 or line 18 ....................................

19.

20. Enter your taxable benefits for the earlier year (or as refigured due to a previous lump-sum payment for the

year) ..................................................................................... 20.

21. Additional taxable benefits. Subtract line 20 from line 19. Also enter this amount on Worksheet

4, line 20 ................................................................................. 21.

-0-

CAUTION

!

Don’t file an amended return for this earlier year. Complete a separate Worksheet 2 or Worksheet 3 for each

earlier year for which you received a lump-sum payment in 2023.

Publication 915 (2023) Page 13

Page 14 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Jane Jackson's Filled-in Worksheet 4. Figure Your Taxable

Benefits Under the Lump-Sum Election Method (Use With

Worksheet 2 or 3) Keep for Your Records

Complete Worksheet 1 and Worksheets 2 and 3 as appropriate before completing this worksheet.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099 for 2023,

minus the lump-sum payment for years before 2023 ................................. 1.

$9,000

Note. If line 1 is zero or less, skip lines 2 through 18, enter -0- on line 19, and go to line 20.

Otherwise, go to line 2.

2. Multiply line 1 by 50% (0.50) ...............................................................

2.

4,500

3. Enter the amount from Worksheet 1, line 3 ....................................................

3.

25,500

4. Enter the amount from Worksheet 1, line 4 ....................................................

4.

-0-

5. Enter the amount from Worksheet 1, line 5 ....................................................

5.

-0-

6. Combine lines 2, 3, 4, and 5 above ..........................................................

6.

30,000

7. Enter the amount from Worksheet 1, line 7 ....................................................

7.

-0-

8. Subtract line 7 from line 6 ..................................................................

8.

30,000

9. Enter the amount from Worksheet 1, line 9. But if you are married filing separately and lived with your spouse at

any time during 2023, skip lines 9 through 16, multiply line 8 by 85% (0.85), and enter the result on line 17.

Then, go to line 18 ....................................................................... 9.

25,000

10. Is the amount on line 8 more than the amount on line 9?

No. Skip lines 10 through 18, enter -0- on line 19, and go to line 20.

Yes. Subtract line 9 from line 8 .......................................................... 10.

5,000

11. Enter the amount from Worksheet 1, line 11 ...................................................

11.

9,000

12. Subtract line 11 from line 10. If zero or less, enter -0- ............................................

12.

-0-

13. Enter the smaller of line 10 or line 11 ........................................................

13.

5,000

14. Multiply line 13 by 50% (0.50) ..............................................................

14.

2,500

15. Enter the smaller of line 2 or line 14 .........................................................

15.

2,500

16. Multiply line 12 by 85% (0.85). If line 12 is zero, enter -0- .........................................

16.

-0-

17. Add lines 15 and 16 ......................................................................

17.

2,500

18. Multiply line 1 by 85% (0.85) ...............................................................

18.

7,650

19. Enter the smaller of line 17 or line 18 ........................................................

19.

2,500

20. Enter the total of the amounts from Worksheet 2, line 21, and Worksheet 3, line 14, for all earlier years for

which the lump-sum payment was received .................................................... 20.

-0-

21. Taxable benefits under lump-sum election method. Add lines 19 and 20 ..........................

21.

$2,500

Next. Is line 21 above smaller than Worksheet 1, line 19?

No. Don’t use this method to figure your taxable benefits. Follow the instructions on Worksheet 1 to report your benefits.

Yes. You can elect to report your taxable benefits under this method. To elect this method, do the following.

1. Enter “LSE” to the left of Form 1040 or 1040-SR, line 6a.

2. If line 21 above is zero, follow the instructions on line 10 for “No” on Worksheet 1. Otherwise:

a. Enter the amount from Worksheet 1, line 1, on Form 1040 or 1040-SR, line 6a;

b. Enter the amount from line 21 above on Form 1040 or 1040-SR, line 6b; and

c. If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of

the word “benefits” on Form 1040 or 1040-SR, line 6a.

Page 14 Publication 915 (2023)

Page 15 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Deductions Related to Your

Benefits

You may be entitled to deduct certain amounts related to

the benefits you receive.

Disability payments. You may have received disability

payments from your employer or an insurance company

that you included as income on your tax return in an earlier

year. If you received a lump-sum payment from the SSA or

RRB, and you had to repay the employer or insurance

company for the disability payments, you can take an

itemized deduction for the part of the payments you inclu-

ded in gross income in the earlier year. If the amount you

repay is more than $3,000, you may be able to claim a tax

credit instead. Claim the deduction or credit in the same

way explained under Repayment of benefits received in an

earlier year under Repayments More Than Gross Benefits

next.

Repayments More Than Gross

Benefits

In some situations, your Form SSA-1099 or RRB-1099 will

show that the total benefits you repaid (box 4) are more

than the gross benefits (box 3) you received. If this occur-

red, your net benefits in box 5 will be a negative figure (a

figure in parentheses) and none of your benefits will be

taxable. Don’t use Worksheet 1 in this case. If you receive

more than one form, a negative figure in box 5 of one form

is used to offset a positive figure in box 5 of another form

for that same year.

If you have any questions about this negative figure,

contact your local SSA office or your local RRB field

office.

Joint return. If you and your spouse file a joint return,

and your Form SSA-1099 or RRB-1099 has a negative fig-

ure in box 5, but your spouse's doesn’t, subtract the

amount in box 5 of your form from the amount in box 5 of

your spouse's form. You do this to get your net benefits

when figuring if your combined benefits are taxable.

Example. John and Mary file a joint return for 2023.

John received Form SSA-1099 showing $3,000 in box 5.

Mary also received Form SSA-1099 and the amount in

box 5 was ($500). John and Mary will use $2,500 ($3,000

minus $500) as the amount of their net benefits when fig-

uring if any of their combined benefits are taxable.

Repayment of benefits received in an earlier year. If

the total amount shown in box 5 of all of your Forms

SSA-1099 and RRB-1099 is a negative figure, you may be

able to deduct part of this negative figure that represents

benefits you included in gross income in an earlier year, if

the figure is more than $3,000. If the figure is $3,000 or

less, it is a miscellaneous itemized deduction and can no

longer be deducted.

Deduction more than $3,000. If this deduction is

more than $3,000, you should figure your tax two ways.

1. Figure your tax for 2023 with the itemized deduction

included on Schedule A (Form 1040), line 16.

2. Figure your tax for 2023 in the following steps.

a. Figure the tax without the itemized deduction in-

cluded on Schedule A (Form 1040), line 16.

b. For each year after 1983 for which part of the neg-

ative figure represents a repayment of benefits, re-

figure your taxable benefits as if your total benefits

for the year were reduced by that part of the nega-

tive figure. Then, refigure the tax for that year.

c. Subtract the total of the refigured tax amounts in

(b) from the total of your actual tax amounts.

d. Subtract the result in (c) from the result in (a).

Compare the tax figured in methods 1 and 2. Your tax

for 2023 is the smaller of the two amounts. If method 1 re-

sults in less tax, take the itemized deduction on Sched-

ule A (Form 1040), line 16. If method 2 results in less tax,

claim a credit for the amount from step 2c above on

Schedule 3 (Form 1040), line 13z. Enter “I.R.C. 1341” on

the entry line. If both methods produce the same tax, de-

duct the repayment on Schedule A (Form 1040), line 16.

Worksheets

Blank Worksheets 1 through 4 are provided in this section.

1. Worksheet 1, Figuring Your Taxable Benefits.

2. Worksheet 2, Figure Your Additional Taxable Benefits

(From a Lump-Sum Payment for a Year After 1993).

3. Worksheet 3, Figure Your Additional Taxable Benefits

(From a Lump-Sum Payment for a Year Before 1994).

4. Worksheet 4, Figure Your Taxable Benefits Under the

Lump-Sum Election Method (Use With Worksheet 2

or 3).

Publication 915 (2023) Page 15

Page 16 of 33 Fileid: … tions/p915/2023/a/xml/cycle02/source 15:42 - 4-Dec-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Worksheet 1. Figuring Your Taxable Benefits Keep for Your Records

Before you begin:

•

If you are married filing separately and you lived apart from your spouse for all of 2023, enter “D” to the right of the word “benefits” on

Form 1040 or 1040-SR, line 6a.

•

Don’t use this worksheet if you repaid benefits in 2023 and your total repayments (box 4 of Forms SSA-1099 and RRB-1099) were

more than your gross benefits for 2023 (box 3 of Forms SSA-1099 and RRB-1099). None of your benefits are taxable for 2023. For

more information, see Repayments More Than Gross Benefits.

•

If you are filing Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, don’t include the amount

from line 2b of Form 1040 or 1040-SR on line 3 of this worksheet. Instead, include the amount from Schedule B (Form 1040), line 2.

1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099. Also

enter this amount on Form 1040 or 1040-SR, line 6a .......................... 1.